GBP/USD climbed higher above the 1.2200 resistance zone. GBP/JPY could rise further if there is a clear move above the 165.70 resistance.

Important Takeaways for GBP/USD and GBP/JPY

- The British Pound is moving higher above 1.2300 against the US Dollar.

- There was a break above a major bearish trend line with resistance near 1.2180 on the daily chart of GBP/USD.

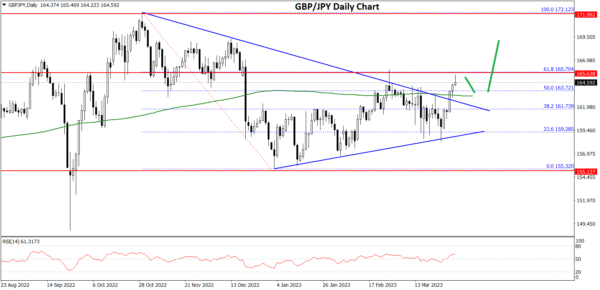

- GBP/JPY is showing a lot of bullish signs above the 162.50 support.

- There was a break above a key contracting triangle with resistance near 162.65 on the daily chart.

GBP/USD Technical Analysis

This past week, the British Pound formed a base above the 1.1800 zone against the US Dollar. The GBP/USD pair started a steady increase above the 1.2000 resistance zone.

There was a clear move above the 1.2120 resistance zone and the 50-day simple moving average. The pair even climbed above the 1.2200 resistance. There was a was a break above a major bearish trend line with resistance near 1.2180 on the daily chart of GBP/USD.

The pair even broke the 1.2350 level. A high is formed near 1.2420 on FXOpen and the pair is now consolidating gains.

An immediate support is near the 1.2180. It is near the 38.2% Fib retracement level of the upward move from the 1.1802 swing low to 1.2418 high. The next major support is near the 1.2120 and 1.2100 levels.

The 50% Fib retracement level of the upward move from the 1.1802 swing low to 1.2418 high is also near the 1.2100 zone. If there is a break below the 1.2100 support, the pair could test the 1.2000 support.

Any more losses might send GBP/USD towards 1.1920. An immediate resistance on the upside is near the 1.2440 level. The next major resistance is near the 1.2500 level, above which the pair could start a steady increase towards 1.2750.

An upside break above 1.2750 might start a fresh increase towards 1.2800. Any more gains might call for a move towards 1.2880 or even 1.2950.

GBP/JPY Technical Analysis

The British Pound started a fresh increase from the 158.50 resistance against the Japanese Yen. The GBP/JPY pair gained pace above the 160.00 resistance zone.

There was a clear move above the 162.20 level and the 50 hourly simple moving average. There was also a break above a key contracting triangle with resistance near 162.65 on the daily chart. There was a move above the 50% Fib retracement level of the downward move from the 172.12 swing high to 155.32 low.

An immediate resistance on the upside is near the 165.70 zone. It is near the 61.8% Fib retracement level of the downward move from the 172.12 swing high to 155.32 low.

The next key resistance could be 167.00. A clear break above the 167.00 resistance could push the pair towards the 168.00 resistance.

If not, the pair might decline below the 163.50 level. On the downside, an initial support is near the 163.20 level. The next major support is near the 162.00. If there is a downside break below the 162.00 support, the pair could decline towards the 160.50 support zone in the coming sessions. Any more losses might call for a test of the 159.20 support zone.