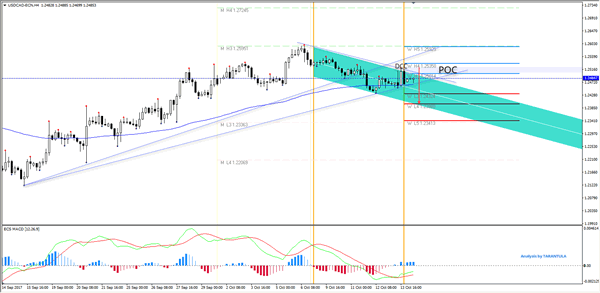

The USD/CAD is showing the DCC (Dark Cloud Cover) variant pattern formation on 4h timeframe. The formation is noticed within the range of Weekly resistance pivots, and the price is trying to pullback within the POC zone where it might reject. The POC zone 1.2500-1.2520 (W H3/H4, trend line, DCC, Descending PPR) could reject the price towards 1.2432 and 1.2398. Have in mind that stronger bearish continuation is possible only when/if the price breaks below EMA89/trendline 1.2460. At this point price is retracing to the POC zone and we will see if the zone will reject it if the price gets into it. Ideally for bears 1.2595 should hold, else the price will probably make a new leg to the upside.

W L3 – Weekly Camarilla Pivot (Weekly Interim Support)

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

M H4 – Daily Camarilla Pivot (Very Strong Monthly Resistance)

M L3 – Daily Camarilla Pivot (Monthly Support)

M L4 – Daily H4 Camarilla (Very Strong Monthly Support)

PPR – Progressive Polynomial Channel

AP -Andrew’s Pitchfork

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)