Australian dollar rose over 1% on Tuesday, lifted by unexpected 25 basis points rate hike by the Reserve Bank of Australia and hawkish stance which signals that more hikes could be expected, in efforts to curb persistently high inflation.

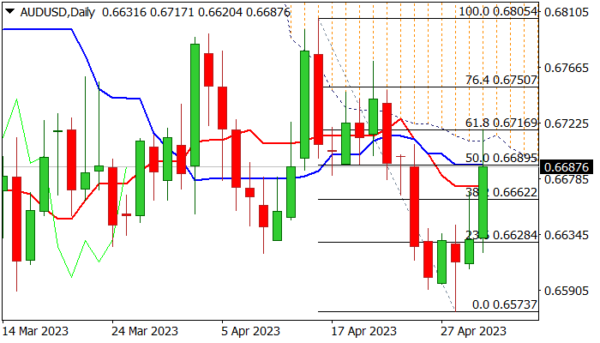

Aussie dollar jumped to the highest since Apr 21, retracing 61.8% of 0.6805/0.6573 bear-leg and sidelining risk of retesting key support at 0.6563 (2023 low posted on Mar 10).

Daily technical studies improved on the latest rally as 14-d momentum is breaking into positive territory and RSI/Stochastic are in steep ascend, however bulls face headwinds from the base of very thick daily cloud (spanned between 0.6708 and 0.6860), as the action cracked cloud base but quickly returned, with daily Tenkan-sen/Kijun-sen still in bearish setup and adding to warning signals.

Firm break of cloud base and nearby Fibo 61.8% of .6805/0.6573 (0.6716) is needed to keep bulls intact for further advance.

Failure under cloud base will signal consolidation, with bullish bias expected while the price stays above 0.6662 (10DMA/broken Fibo 38.2%).

Loss of 0.6662 pivot would initial signal recovery stall and make the downside more vulnerable.

Res: 0.6708; 0.6716; 0.6750; 0.6805.

Sup: 0.6672; 0.6662; 0.6628; 0.6591.