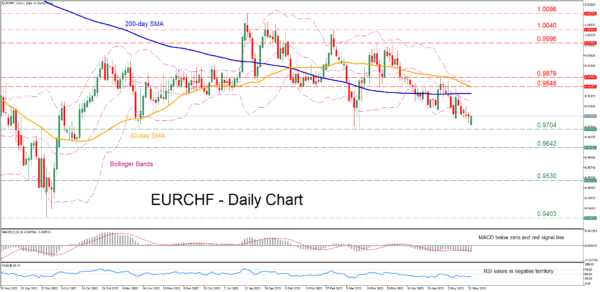

EURCHF has been trending lower since its latest rebound got rejected just shy of the parity level in late March. In addition, the price retreated below both its 50- and 200-day simple moving averages (SMAs), which are set to post a bearish cross, painting an even gloomier technical picture for the pair.

The short-term oscillators currently suggest that bearish forces are reigning supreme. Specifically, the MACD dropped below its red signal line in the negative territory, while the RSI is flatlining beneath its 50-neutral mark.

Should the recent downtrend resume, the price could be on track to challenge the 2023 bottom of 0.9704. Breaking below that zone, the pair might descend to levels not seen in months, where the October support of 0.9642 may provide downside protection. If that barricade fails, the spotlight could turn to the 0.9530 hurdle.

On the flipside, bullish actions could propel the price towards 0.9848, which served as both resistance and support in the past, and overlaps with the 50-day SMA. Conquering this obstacle, the price could ascend towards the April resistance of 0.989 before 0.9996 comes under examination. Further advances might then stall around the February peak of 1.0040.

Overall, EURCHF seems to be extending its structure of lower highs and lower lows, getting ready to test its 2023 bottom. However, the price is currently below its lower Bollinger band, indicating that the market could have reached oversold conditions and hinting at a potential upside correction.