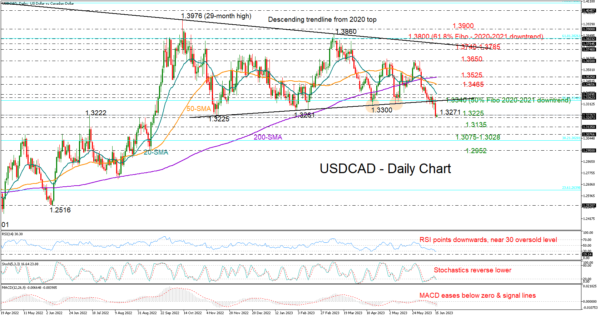

USDCAD corrected sharply lower to a nine-month low of 1.3200 on Thursday, following the close below the support trendline, which had been buffering downside movements since November.

The pair is in the third week of declines and could keep going down despite today’s lack of selling pressure. The RSI and stochastic oscillator are close to oversold levels, suggesting a sideways move or upside reversal, but they are not changing direction to the upside yet. The falling MACD is also reflecting dampened market sentiment.

It’s also worthy to note that the 50- and 200-day simple moving averages (SMAs) have posted a death cross for the first time since August 2020. The 20-day SMA has crossed below the longer-term SMAs too, flagging a potential deterioration in the market trend.

Therefore, if the 1.3200 base proves fragile, the bearish wave could stretch towards the 1.3135 barrier and then revisit the 1.3075-1.3028 zone where the 38.2% Fibonacci retracement level of the 1.4667-1.2007 downleg is placed. The 1.2952 low from mid-September could be the next target.

In the case the price edges above the July-November constraining zone of 1.3225, the bulls may revisit the almost flat broken trendline and the 23.6% Fibonacci mark of 1.3340. A decisive close above that border is required to generate fresh buying interest. If efforts prove successful, with the price also piercing through the 20-day SMA, the next resistance could occur somewhere between the 50- and 200-day SMAs at 1.3465 and 1.3525 respectively. Another victory for the bulls here could clear the way towards the tough resistance of 1.3650.

Summing up, a new bearish threat could emerge in USDCAD, but traders need to wait for a confirmation signal below the 1.3200 psychological mark.