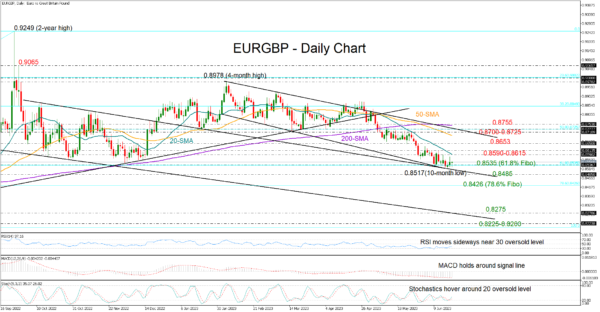

EURGBP marked a 10-month low of 0.8517 at the bottom of the four-month-old bearish channel on Monday, fully reversing its December-February ascent ahead of the Bank of England’s policy announcement due on Thursday.

The 61.8% Fibonacci retracement of the 0.8200-0.9249 uptrend has been cooling downside pressures since the start of the week as well. Still, traders may hesitate to raise their exposure in the market unless the price increases back above the falling 20-day simple moving average (SMA) at 0.8590 and closes above the 0.8615 resistance. If the bulls successfully breach the latter point, they could initially take a breather around the 0.8650 zone before speeding up to test the 50-day SMA at 0.8692. Slightly higher, the channel’s upper boundary, which overlaps with the 50% Fibonacci mark of 0.8725 could be a tougher obstacle.

From a technical perspective, the risk is looking bearish-to-neutral. The RSI is moving sideways around its 30 oversold level, the stochastic oscillator is also lacking direction, while the MACD remains attached to its red signal line way below the zero line. Strikingly, the 50-day SMA has recently slid below the 200-day SMA for the first time since January 2021, warning of a potential deterioration in the market trend.

Hence, a continuation lower cannot be excluded. In this case, a move below the channel could immediately stall somewhere between 0.8485 and the 78.6% Fibonacci of 0.8425. If the bears persist, the pair could come under significant pressure, likely sinking towards the September support trendline at 0.8278. Another extension lower from here may halt within the 0.8223-0.8200 zone, where the aggressive 2020-2021 sell-off paused.

In brief, EURGBP is not out of the woods yet despite stabilizing near a crucial support area. A decisive rally above 0.8615 will be needed to bring the bulls back into play.