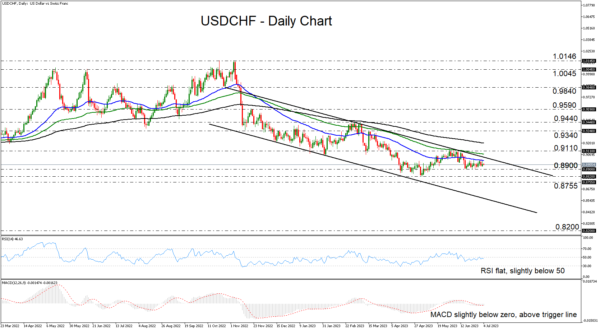

USDCHF has been trading in a sideways manner since June 16, between the 0.8900 support zone and the 50-day exponential moving average (EMA). That said, in the bigger picture, the pair remains within the downward sloping channel that’s been containing the price action since November 10, which keeps the risk of another leg south firmly on the table.

Both the RSI and the MACD indicate a lack of directional speed, corroborating the latest sideways action above 0.8900. The former is flat slightly below its equilibrium 50 mark, while the latter lies fractionally below zero, but still above its trigger line.

For the downtrend to decently extend, the bears may need to overcome, not only the 0.8900 zone, but also the 0.8820 level, marked by the low of May 4, and the 0.8755 territory, which stopped the pair from falling further back in January 2021. If this happens, USDCHF may tumble all the way down to the 0.8200 zone, which marks the low hit just after the SNB removed the 1.20 EURCHF floor back in 2015.

For the outlook to start being considered bullish, USDCHF may need to overcome the 0.9110 area, which offered strong resistance between May 30 and June 12. Such a move would confirm a higher high and the upside exit out of the aforementioned downside channel. The bulls may then get encouraged to climb to the 0.9340 zone, the break of which could aim for the 0.9440 barrier, marked by the highs of March 2 and 8.

To wrap up, USDCHF has been trading sideways since mid-June, but in the bigger picture, it remains within a downside channel since November. This keeps the near-term outlook cautiously negative. For the outlook to change to bullish, the pair may need to rebound and break above the 0.9110 zone.