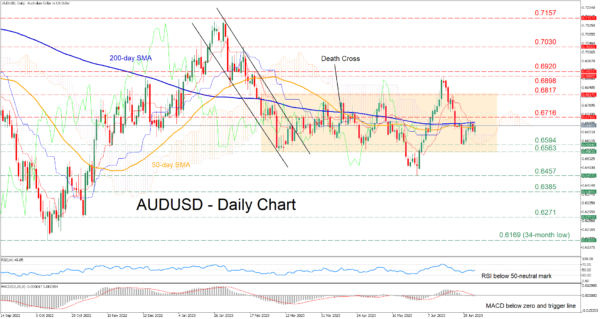

AUDUSD has been on a wild ride during the past two months, posting a false bearish breakout from its rangebound pattern which was followed by a false bullish breakout. In the past few sessions, the pair has been repeatedly held down by the 200-day simple moving average (SMA), but the bulls have not surrendered yet.

This inability to claim the congested region that includes both the 50- and 200-day SMAs is also reflected in the short-term oscillators. Specifically, the RSI has failed multiple times to jump above the 50-neutral mark, while the MACD remains below both zero and its red signal line.

If bullish pressures persist and the price crosses above the 200-day SMA, the recent resistance of 0.6716 might curb initial advances. Clearing this region, the pair could face 0.6817, which is the upper border of the rectangle pattern. A violation of that zone could pave the way for the four-month peak of 0.6898.

On the flipside, bearish actions could send the price back towards the recent support of 0.6594. Should that barricade fail, the spotlight could turn to the March bottom of 0.6563, which coincides with the floor of the recent rangebound movement. Dipping lower, the pair could descend towards the 2023 bottom of 0.6457.

In brief, AUDUSD remains capped by its 200-day SMA despite buyers’ consecutive attempts to conquer that region. For a recovery to occur, the price needs to clearly jump above this fortified zone.