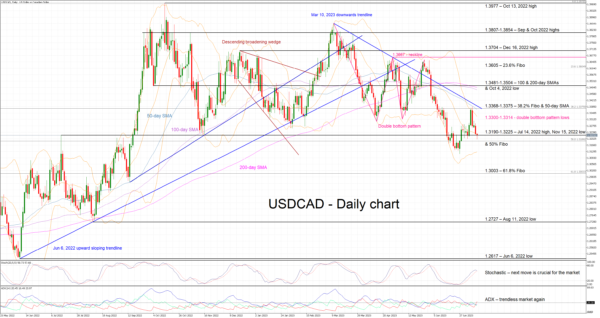

USDCAD’s recovery proved very short-lived as the pair has been dropping aggressively over the past four sessions. It is currently hovering inside the busy 1.3190-1.3225 area with the bears probably keen on continuing the recent series of lower highs and lower lows. The next trough has to occur below the 1.3116 low recorded on June 27 in order to keep this structure intact and valid.

The continued convergence of the 100- and 200-day simple moving averages (SMAs) supports the possibility of another sizeable move, but the bears have to look at the momentum indicators for clues on the direction of this next move. With the Average Directional Movement Index (ADX) not supporting the current downleg and still pointing to a range-trading market, the focus turns to the stochastic oscillator. This indicator is currently battling with its moving average (MA) and its next move will probably send a strong signal of the likely direction of the next leg in USDCAD.

If the stochastic manages to break below its MA, the bears would feel more confident in breaking the current 1.3190-1.3225 range that is defined by the July 14, 2022 high, the November 15, 2022 low and 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 uptrend respectively. The bears would then have the chance of recording a lower low, below the 1.3116 level, and then be able to target the 61.8% Fibonacci retracement at 1.3003.

Should the stochastic bounce higher, the bulls could try to stage another small upleg. The 1.3300-1.3314 range is unlikely to trouble them much but the same cannot be said for the busier 1.3368-1.3375 area. This is populated by the 38.2% Fibonacci retracement and the 50-day SMA, and proved too strong for the bulls at their July 7 attempt. If successful, the door will then be open for a retest of the key 1.3481-1.3504 range.

To sum up, USDCAD bears are keen on recording another lower low but their fate rests in the hands of the stochastic oscillator.