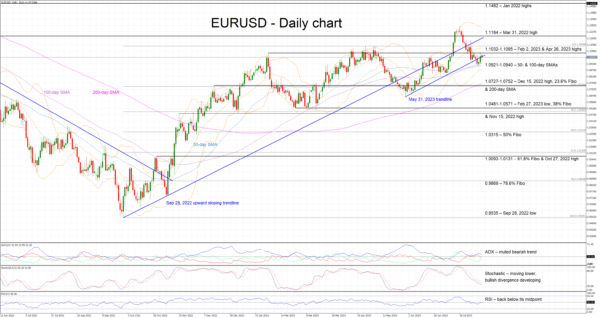

EURUSD is edging lower today as it appears to be affected by the summer lull. The pair is actually hovering a tad above the 1.0921-1.0940 area and currently battling with the May 31, 2023 upward sloping trendline. In the meantime, the continued convergence of the 50- and 100-day simple moving averages (SMAs) has yet to play a role.

Amidst this environment, most momentum indicators confirm the presence of bearish pressure. The Average Directional Movement Index (ADX) is slightly above its 25-threshold and thus pointing to a muted bearish trend in the market, and the RSI is again trading below its midpoint. More interestingly, the stochastic oscillator is moving lower and has built a good gap from its moving average. However, the current lower low in the stochastic has been met by a higher low in EURUSD and thus is pointing to a developing bullish divergence.

Should the bears attempt to stage a pullback, they would try to overcome the support set by the 50- and 100-day (SMAs) at the 1.0921-1.0940 range. They could then have a look at the busier 1.0727-1.0752 area that is populated by the December 15, 2022 high, the 200-day SMA and the 23.6% Fibonacci retracement of the September 28, 2022 – April 26, 2023 uptrend respectively.

On the flip side, if the bulls try to take advantage of the stochastics’ developing divergence, they could aim for a move above the May 31, 2023 trendline and the busy 1.1032-1.1095 range, which is defined by the February 2, 2023 and April 26, 2023 highs respectively. They would then have a go at testing the resistance set by the September 28, 2022 upward sloping trendline, a tad below the March 31, 2022 high at 1.1184.

To conclude, calmer market conditions appear to favour EURUSD bears at this juncture with the bulls appearing determined to defend the busy 1.0921-1.0940 area.