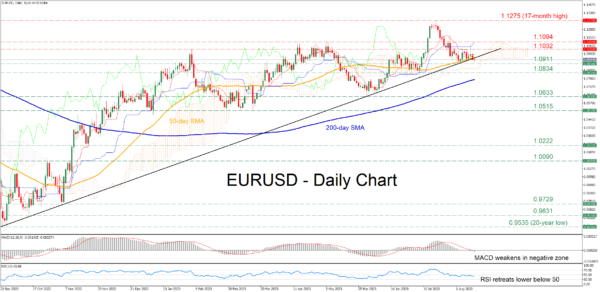

EURUSD has been trading sideways for the past two weeks after experiencing a downside correction from its 17-month high of 1.1275. However, the technical picture is slowly tilting towards the bearish side as the price has fallen beneath both the 50-day simple moving average (SMA) and the ascending trendline that connects its higher lows since September 2022.

The momentum indicators currently suggest that bearish forces are intensifying. Specifically, the MACD is softening below both zero and its red signal line at its lowest level since June 14, while the RSI is descending below its 50-neutral threshold.

Should we see a clear close below the trendline, the recent support of 1.0911 could act as the first line of defense. Violating this territory, the price may face the July low of 1.0834 ahead of the May bottom at 1.0633. Even lower, the 1.0515 hurdle could provide downside protection.

On the flipside, if the recent range breaks to the upside, the February high of 1.1032 might prove to be the first barricade for the bulls to conquer. A jump above that zone may open the door for 1.1094, which held strong three times in April. Should that hurdle also fail to provide resistance, the spotlight could turn to the 17-month peak of 1.1275.

In brief, EURUSD seems to be stuck in a tight range, but a decisive break below the fortified region that includes the upwards sloping trendline and the 50-day SMA could trigger a strong selloff. Can the bulls fight back?