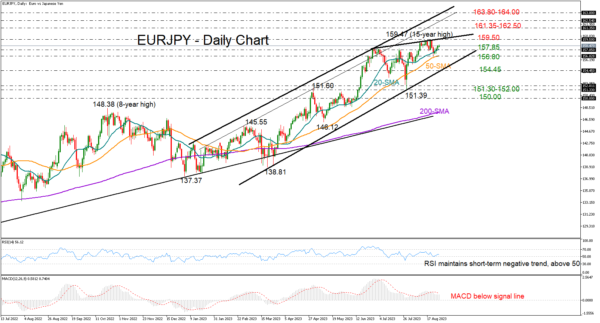

EURJPY climbed back above its 20-day simple moving average (SMA), aiming to push its 2023 uptrend above last week’s high of 159.47.

The upward-sloping SMAs promote the positive trend in the market, but the technical oscillators can’t warrant stronger bullish momentum in the coming sessions. The RSI is maintaining a negative trajectory above its 50 neutral mark despite pivoting higher recently, while the MACD keeps hovering below its red signal line, indicating some skepticism in the market.

Nevertheless, if the bulls take over the 159.50 bar and the short-term resistance line from June, the price might revisit the 161.35-162.50 zone, where it struggled at the end of August 2008 and peaked in August-October 1998. A close higher could then target the tentative ascending line from January 2023 seen around 163.80-164.00.

Alternatively, a pullback below the 20- and 50-day SMAs at 157.85 and 156.80, respectively, may confirm additional losses towards the tentative support trendline at 154.45. An extension lower may stabilize somewhere between 151.30 and 152.00. If the sell-off continues, the door will open for the 150.00 psychological number.

In brief, EURJPY’s short- and medium-term bullish structure provides safeguard, but it’s still uncertain if there are enough buyers to upgrade the market’s outlook above the 159.50 ceiling.