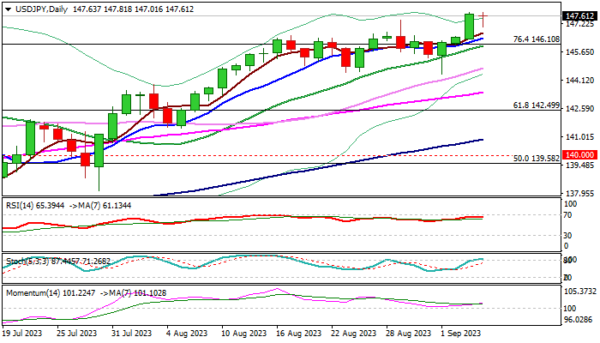

USD/JPY bulls are taking a breather after three-day rally which accelerated to new 2023 high on Tuesday (the pair was up 0.9% for the day).

Traders remain cautious on looming intervention, as Japan’s authorities reiterated their readiness to intervene at any time to support weakening national currency, although larger bulls remain firmly in play, with signals of further advance seen on daily chart.

In addition, much better than expected US non-manufacturing PMI figures (Aug 54.5 at seven-month high vs July 52.7 and 52.5 f/c) adds to positive signals for dollar.

On the other hand, overbought conditions on daily chart may keep the pair in a narrow consolidation (ideally to be contained at 146.10 zone (daily Tenkan-sen / broken Fibo 76.4%, former strong resistance) to keep bulls in play and offer better buying opportunities.

Only acceleration through 144.60/40 zone (daily Kijun-sen / higher base) would sideline bulls and open way for deeper correction.

Res: 147.81; 148.84; 149.7; 150.00

Sup: 147.01 146.43; 146.10; 145.35