- GBPJPY slid below 50-day SMA after BoE surprise decision to hold rates steady

- Remains in a gentle downward path despite today’s bounce after BoJ leaves policy unchanged

- Will the short-term pullback extend?

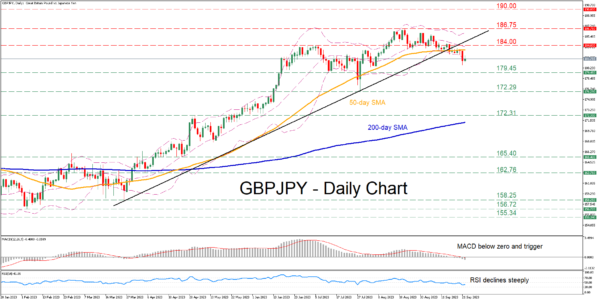

GBPJPY had been stuck in a prolonged uptrend since the beginning of the year, posting an eight-year high of 186.75 on August 22. However, the pair has been experiencing a downside correction since then, with the momentum indicators suggesting more losses in the near term.

If selling interest persists, the July support of 179.45 could provide initial downside protection. Breaking below that zone, the price might face the July bottom of 172.29. A violation of that hurdle could open the door for the May resistance of 172.31, which could serve as support in the future.

Alternatively, should the price reverse back higher and reclaim its 50-day simple moving average (SMA), the bulls could attack the July peak of 184.00. Piercing through that wall, the pair could attempt to re-test its eight-year high of 186.75. If that barricade also fails, the price could ascend to fresh multi-year highs, where the 190.00 psychological mark might curb further upside attempts.

In brief, GBPJPY has been undergoing a strong pullback, which strengthened after the BoE’s dovish surprise. Nevertheless, traders should not rule out an impending bounce as the price is trading below the lower Bollinger band, hinting that the pair has reached oversold conditions.