- USDCHF snaps key floor; short-term bias bearish

- Downside pressure could stay limited above 50-day SMA

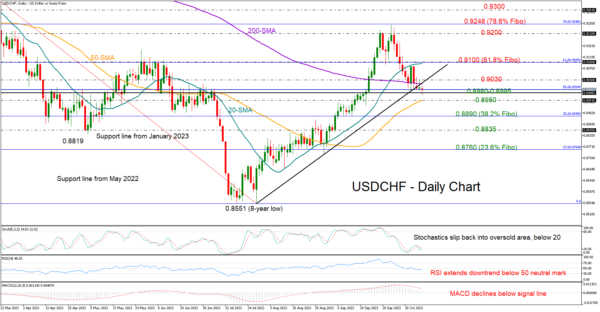

USDCHF is marking its third consecutive bearish week, having recently enhanced negative risks below the protective 200-day simple moving average (SMA) and the support trendline from July’s lows.

The 0.8980-.8995 restricted zone, which had been capping upside movements during April-July 2023, could switch into a support area, while the 50-day SMA at 0.8950 could provide the last opportunity for a rebound before a freefall towards the 0.8890 mark takes place. The 38.2% Fibonacci retracement of the 0.9437-0.8551 downtrend is also located there. Hence, a step lower could further dampen sentiment, likely pressing the price towards the 0.8835 barrier and then down to the 23.6% Fibonacci of 0.8760.

According to the technical indicators, the short-term bias is still on the bearish side, with the RSI extending its downtrend below its 50 neutral mark and the MACD losing ground below its red signal line. On the other hand, the stochastic oscillator has already entered the oversold area below 20, increasing speculation that selling interest could be short-lived.

Nevertheless, the pair may struggle to gain significant positive impetus until it returns above its 200-day SMA and more importantly above its 20-day SMA at 0.9100 (61.8% Fibonacci). If that scenario unveils, the pair could advance straight into the 0.9200-0.9248 ceiling. A successful penetration higher may stall near the 0.9300 round level, while higher, the focus will turn to the 2023 top of 0.9437.

All in all, USDCHF remains exposed to downside risks, likely facing its next bearish wave below the 50-day SMA at 0.8950.