- EURUSD peaks in overbought zone; trend signals still positive

- ECB rate announcement comes center stage at 13:15 GMT

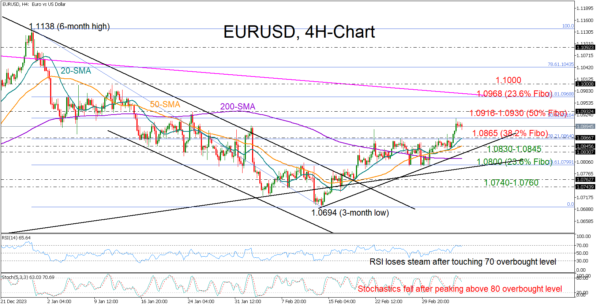

EURUSD resumed its recovery phase on Wednesday, rising as high as 1.0914 – the highest level since January – before easing slightly lower again.

The pair seems to have met overbought conditions in the four-hour chart as both the RSI and the Stochastic oscillator are pivoting lower after peaking around 70 and 80, respectively. Interestingly, the warning signals came after the price faced a strong rejection near the 50% Fibonacci retracement of the previous downtrend, shifting the focus back to the downside.

The 38.2% Fibonacci mark of 1.0865, where the 20-period simple moving average (SMA) is placed, is now under the spotlight. A close beneath that constraining zone might press the price straight to the tentative support trendline from February’s lows at 1.0830, unless the 50-period SMA blocks the way down beforehand. Even lower, the bears could drive towards the 23.6% Fibonacci level of 1.0800, a break of which could generate more losses to 1.0740-1.760.

On the other hand, trend signals provide a ray of hope that the ongoing bullish wave might gain extra legs. The pair has printed a new higher high and the recent bullish cross between the 20- and 50-period SMAs could be a signal of more progress ahead. Nevertheless, buyers would like to see a decisive bounce above the 1.0916-1.0930 resistance zone before they stage a rally towards the 61.8% Fibonacci level of 1.0968 and the 1.1000 psychological number.

In brief, EURUSD’s short-term bullish pattern seems healthy for now, with the price expected to take a breather before continuing higher.