- GBPUSD prints new low for this year

- Bearish continuation is likely below 1.2480-1.2500

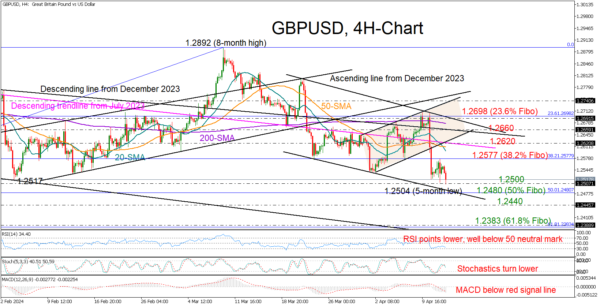

GBPUSD suffered a freefall in the face of hotter-than-expected US CPI inflation data on Tuesday and dropped to a new low of 1.2504 on Friday, retracing back to December’s lows and to the bottom of a broader range area.

Despite the consolidation phase, the rejection from the 38.2% Fibonacci retracement of the October 26-March 8 uptrend suggests another bearish wave is likely. This is evident by the negative slope in the momentum indicators too, which reflect persisting selling interest.

A close below the 1.2500 round level may lead to an immediate pause near the 23.6% Fibonacci mark of 1.2480. If the sell-off expands below the 1.2440 barrier, the pair might seek shelter somewhere between the 61.8% Fibonacci level of 1.2383 and the tentative support line from December at 1.2350.

On the upside, the bulls will have to breach the border at 1.2577 in order to access the descending line from July 2023 at 1.2620. The downward line from December’s peak at 1.2660 may prevent any further advances towards the 1.2698 resistance area, where the 23.6% Fibonacci and the tentative resistance line from March are located. Even higher, the rally could stall within the 1.2440-1.2460 region.

Overall, the latest sell-off in GBPUSD has negatively affected the short-term outlook, and further losses are expected if the bears successfully breach the 1.2500 floor.