- GBPJPY in the green again, returns to pre-intervention levels

- Increasing possibility of another BoJ intervention

- Momentum indicators remain mostly bullish

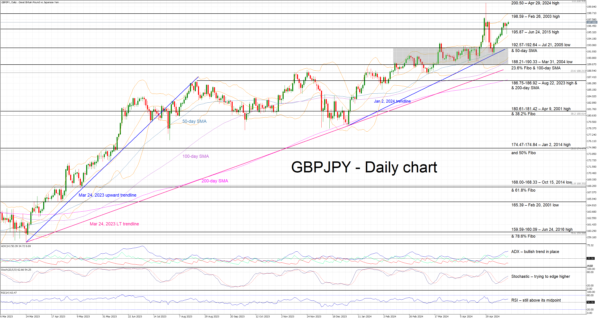

GBPJPY is edging higher again today, recording its ninth green candle in the last 10 sessions. The bearish momentum after the recent BoJ interventions has faded with the pair quickly returning to pre-intervention levels. This move raises the possibility for another swift reaction from the BoJ, especially as the recent Japanese data releases continue to disappoint.

In the meantime, momentum indicators are bullish but there are some early signs of a rally exhaustion. More specifically, the Average Directional Movement Index (ADX) is edging higher, signaling the presence of a strong bullish trend in GBPJPY, but it appears unable to record a higher high.

Similarly, the RSI has climbed again above its midpoint, confirming the ongoing bullish pressure, but it is currently trading sideways. More importantly, the stochastic oscillator has broken above its moving average, and is tentatively edging higher. Should this move pick up pace, it would be seen as a strong bullish signal.

If the bulls remain confident, they could lead GBPJPY higher towards the 198.59 level and then set their eyes on a much bigger prize – the April 29, 2024 high at 200.50. However, if successful, they would be trading at levels that could provoke another intervention from the Japanese authorities.

On the other hand, the bears could try to push GBPJPY back below the June 24, 2015 high at 195.87, and towards the 192.57-192.64 area, which is populated by the July 21, 2005 and the 50-day simple moving average (SMA), as well as the January 2, 2024 trendline. They could then test the support set by the 188.21-190.33 range and potentially lead GBPJPY below the recent rectangle pattern for the first time since early March.

To sum up, the bulls are pushing GBPJPY higher, closer to pre-interventions levels, and increasing the pressure on the BoJ to intervene again.