USD/JPY is holding steady at 157.93 on Monday, with the Japanese yen attempting to strengthen amid volatile movements. Demand for defensive assets has increased as geopolitical and trade risks resurface.

U.S. President Donald Trump has threatened new tariffs against eight European countries in response to tensions over Greenland. These remarks have sparked backlash from European leaders and heightened market uncertainty.

Domestic attention is also focused on the upcoming Bank of Japan (BOJ) meeting, where the market expects the central bank to maintain its current policy stance. Investors are looking to June as a potential timeline for the first rate hike. Adding to the uncertainty, rumors about early elections in Japan are circulating. Prime Minister Sanae Takaichi may announce elections next month to consolidate his position and promote a more flexible budget policy. As part of his campaign, Takaichi is also considering temporarily suspending the 8% food sales tax to ease the burden of rising food prices.

Technical Analysis:

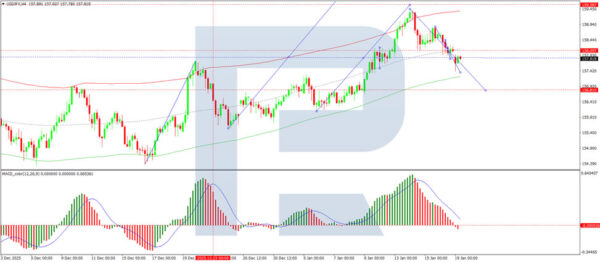

On the H4 chart, USD/JPY is consolidating around the 158.10 level, with the market recently breaking down from this range. A potential decline to 156.81 is in focus, with a rebound to 158.10 possible after reaching that level. The MACD indicator supports this bearish outlook, as its signal line remains below the zero mark and points downward.

On the H1 chart, a downward wave towards 157.36 is forming, with a possible correction to 158.10 before another decline to 156.81. This scenario is confirmed by the Stochastic oscillator, which shows the signal line descending towards the 20 level.

Conclusion:

USD/JPY remains in a consolidation phase, with the market reacting to both domestic and international uncertainties. Investors are closely watching the BOJ meeting and the potential for political developments in Japan. Technically, the pair is showing signs of short-term bearishness, with further declines possible in the near term.