Key Highlights

- USD/JPY trimmed all gains and traded below 155.00.

- It traded below a key bullish trend line with support at 155.20 on the 4-hour chart.

- EUR/USD is consolidating above the 1.1840 support.

- The US CPI could rise by 2.5% in Jan 2026 (YoY).

USD/JPY Technical Analysis

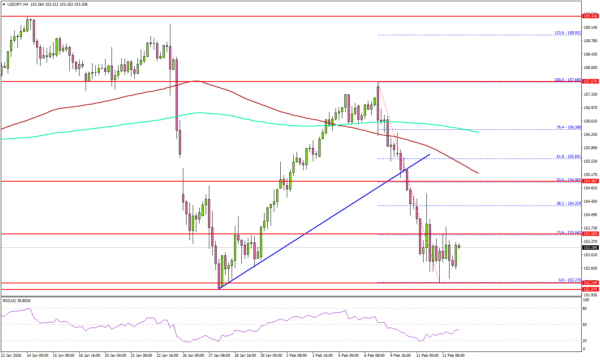

The US Dollar failed to extend gains above 157.50 against the Japanese Yen. USD/JPY dipped below 155.50 and 155.00 to enter a bearish zone.

Looking at the 4-hour chart, the pair dipped below a key bullish trend line with support at 155.20. The pair even settled below the 100 simple moving average (red, 4-hour) and the 200 simple moving average (green, 4-hour).

A low was formed at 152.27, and the pair is now consolidating below the 23.6% Fib retracement level of the downward move from the 157.66 swing high to the 152.27 low.

On the upside, the pair could face hurdles near 153.50. The next stop for the bulls might be 154.00. A close above 154.00 could open the doors for more gains. In the stated case, the bulls could aim for a move toward the 50% Fib retracement level of the downward move from the 157.66 swing high to the 152.27 low at 154.95.

Any more gains could set the pace for a fresh move to 156.50. Immediate support could be 152.65. The first major area for the bulls might be near 152.20. The main support sits at 151.50, below which the pair might gain bearish momentum. In the stated case, it could even revisit 150.00.

Looking at EUR/USD, the pair struggled to clear 1.1920 and might again decline if it fails to stay above 1.1800.

Upcoming Key Economic Events:

- US Consumer Price Index for Jan 2026 (MoM) – Forecast +0.3%, versus +0.3% previous.

- US Consumer Price Index for Jan 2026 (YoY) – Forecast +2.5%, versus +2.7% previous.

- US Consumer Price Index Ex Food & Energy for Jan 2026 (YoY) – Forecast +2.5%, versus +2.6% previous.