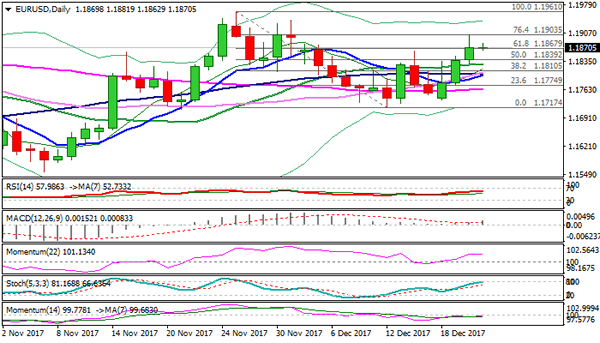

The Euro maintains firm tone on Thursday and consolidating under fresh high at 1.1900. Wednesday’s close marginally above 1.1867 (Fibo 61.8% of 1.1961/1.1717) was bullish signal, despite strong upside rejection which left bullish daily candle with long upper shadow. Weaker dollar on waning optimism over US tax overhaul, keeps the Euro inflated, however, three-day rally from 1.1737 trough may take a breather as slow stochastic is entering overbought territory on daily chart. Deeper dips off 1.1900 spike high are expected to find footstep above 1.1828/23 (20SMA/daily cloud top) to keep near-term bulls in play for renewed attack at 1.1900 and extension towards 1.1961 (27 Nov high) psychological 1.2000 barrier. No releases from EU scheduled today and markets will be looking for US Q3 GDP data for fresh signals.

Res: 1.1881, 1.1900, 1.1940, 1.1961

Sup: 1.1862, 1.1828, 1.1823, 1.1810