Currency pair USD/JPY

The USD/JPY broke below support again (dotted blue) and has invalidated the bullish pattern and outlook. A larger bearish correction is now most likely and price could test the bottom of wave W (pink) at 111 or even break the bottom and move towards the round levels of 110.50 and 110

The USD/JPY bearish momentum looks strong and price could continue lower after price builds and breaks a chart pattern.

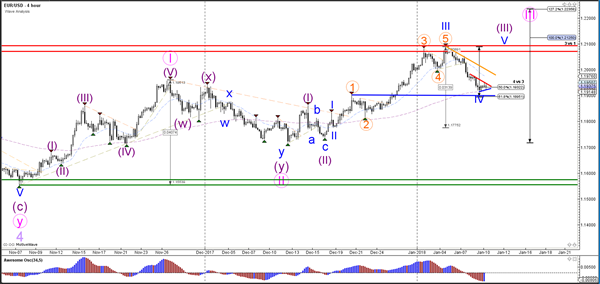

Currency pair EUR/USD

The EUR/USD bearish breakout fell towards the Fibonacci levels of wave 4 vs 3 (blue) and has arrived at the 50-61.8% support zone. A break below the support trend line (blue) and 61.8% Fib of wave 4 makes a bearish scenario more likely. In that case, the alternative outlook is that price is not completing a 123 (pink) but a larger ABC correction.

The EUR/USD broke the support trend line and continued with the bearish price movement. A break above the resistance trend line (red) could be a first sign that wave C is over whereas a break below support could see price fall further. A push below the 61.8% Fib makes this wave 4 unlikely.

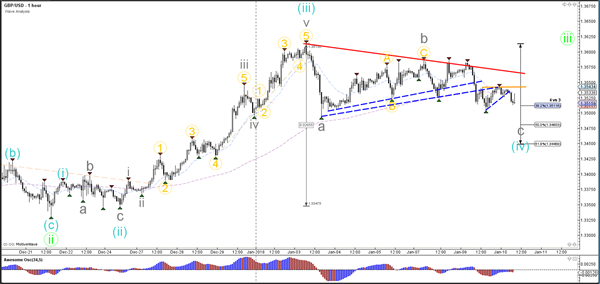

Currency pair GBP/USD

The GBP/USD broke the support (dotted blue) of the corrective pattern. A break above the resistance trend lines (orange/red) could see price move towards the Fibonacci targets whereas a break below support (blue) could see price make a larger bearish reversal.

The GBP/USD broke multiple trend lines which could be part of ABC corrective pattern as long as price stays above the 50-61.8% Fib zone of wave 4.