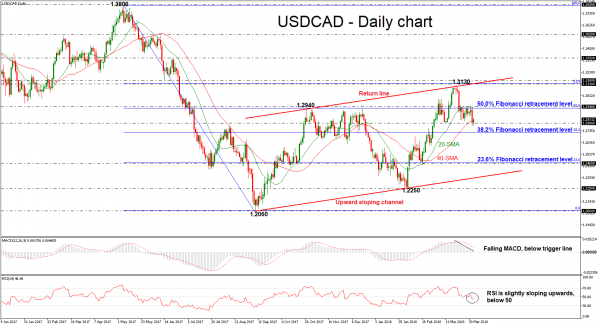

USDCAD has been consolidating since September 2017 and has been stuck in a channel titled slightly to the upside. The neutral to bullish picture in the short term looks to last for a while longer after prices failed to break above the upper channel in mid-March for a more clear tendency.

Resistance was met at around 1.2940 region, which holds near the 50.0% Fibonacci retracement level of the downleg from 1.3800 to 1.2060, forcing the pair to reverse lower. The negative bias in the near term is supported by the MACD oscillator. The index is falling below its trigger line and is approaching the negative zone. However, the RSI indicator stands below the 50 level but is sloping slightly to the upside.

If prices continue to head lower, below the 1.2800 handle, support could come from the 38.2% Fibonacci mark of 1.2720. A drop below this region would reinforce the short-term bearish correction and open the way towards the 23.6% Fibonacci near 1.2460.

However, should an upside reversal take form, immediate resistance will likely come from the 20-day SMA around 1.2940 and the 50.0% Fibonacci. A successful penetration of the latter level could shift the bias back to a bullish one, with the next resistance coming from 1.3130 level.