Key Highlights

- The British Pound found support near 147.00 and recovered sharply against the Japanese Yen.

- There was a break above a key bearish trend line with resistance at 148.20 on the 4-hour chart of GBP/JPY.

- Japan’s Current Account posted a trade surplus of ¥3,122.3B in March 2018, compared with the ¥3,009.2B forecast.

- Today, the BOE Interest Rate Decision is lined up, and the central bank is likely to keep rates at 0.5%.

GBPJPY Technical Analysis

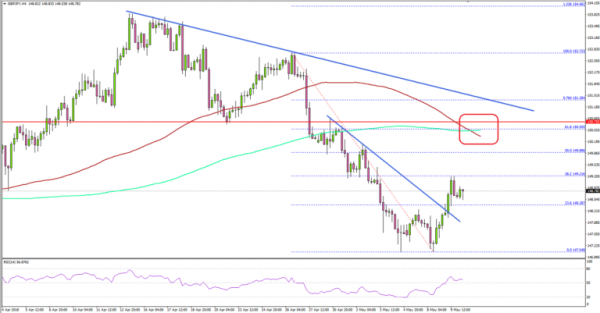

The British Pound found a strong support near 147.00 after a major decline against the Japanese Yen. The GBP/JPY pair is currently correcting higher and is placed nicely above 148.40.

Looking at the 4-hours chart, the pair started a decent upward move and broke the 23.6% Fib retracement level of the last decline from the 152.72 high to 147.04 low.

More importantly, there was a break above a key bearish trend line with resistance at 148.20 on the same chart. To the topside, there are many hurdles for buyers around the 150.00 and 150.50 levels.

Both the 100 (red) and 200 (green) simple moving averages are positioned near 150.50. Moreover, the 61.8% Fib retracement level of the last decline from the 152.72 high to 147.04 low is at 150.55. Therefore, if the pair continues to move higher, it is likely to face sellers near the 150.50 level.

An intermediate resistance is around 150.00 and the 50% Fib retracement level of the last decline from the 152.72 high to 147.04 low. On the downside, the 148.40 level is a decent support, followed by 148.00.

Today, there are many high risk events lined up in the UK and US, including BOE Interest Rate Decision, UK’s Production report, US Initial Jobless Claims and US CPI. These events are likely to impact the market, and pairs like EUR/USD, GBP/USD, USD/JPY and NZD/USD may become volatile.

Economic Releases to Watch Today

- UK Industrial Production for March 2018 (MoM) – Forecast +0.2%, versus +0.1% previous.

- UK Manufacturing Production for March 2018 (MoM) – Forecast -0.2%, versus -0.2% previous.

- UK Trade Balance non-EU for March 2018 – Forecast £-3.34B, versus £-2.24B previous.

- BoE Interest Rate Decision – Forecast 0.50%, versus 0.50% previous.

- US Initial Jobless Claims – Forecast 218K, versus 211K previous.

- US Consumer Price Index April 2018 (MoM) – Forecast +0.3%, versus -0.1% previous.

- US Consumer Price Index April 2018 (YoY) – Forecast +2.5%, versus +2.4% previous.

- US Consumer Price Index Ex Food & Energy April 2018 (YoY) – Forecast +2.2%, versus +2.1% previous.