BoE is widely expected to keep monetary policy unchanged today, with Bank Rate held at 0.10% and asset purchase target at GBP 895B. The overall tone on recovery should be upbeat given strong economy data flow. Yet, uncertainty remains high, in spite of high vaccination rate, regarding the third wave of the coronavirus pandemic that delayed restrictions easing. Headline inflation came in above BoE’s target in May. But the MPC would continue to view the movements as temporary and transitory.

Overall, BoE would wait until August meeting to decide on tapering. By then, new economic projections would be released with the Monetary Policy Report. Also, the situation regarding infections and reopening should be way clearer.

Here are some previews:

- BOE Preview: Not Yet Time for Tapering as Virus Resurgence Raises Economic Uncertainty

- Bank of England May Not Join the Tightening Club Yet

- Will Above Target Inflation Prompt The BoE To Act?

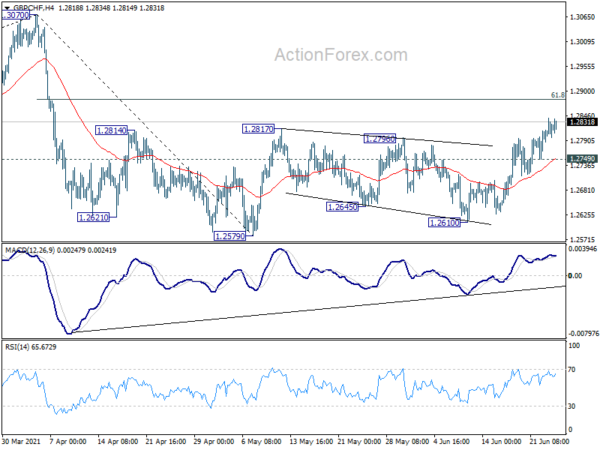

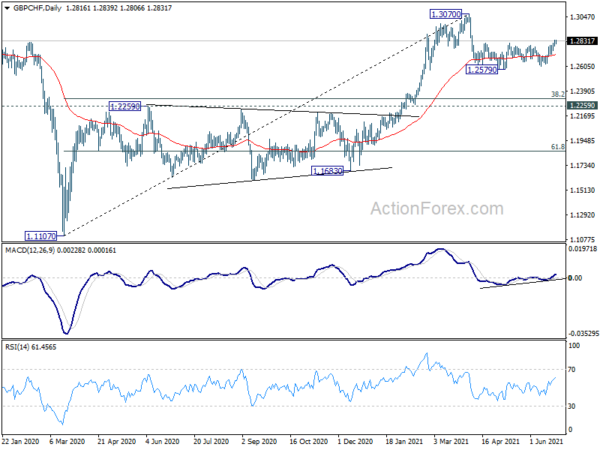

Sterling is currently the slightly better performer among European majors. There is prospect of further rally if BoE delivers some hawkish votings. In particular, GBP/CHF’s rebound from 1.2579 resumed by breaking 1.2817 resistance this week. The development also argues that correction from 1.3070 has completed after struggling around 55 day EMA.

Further rise is now in favor as long as 1.2749 minor support holds. Sustained trading above 61.8% retracement of 1.3070 to 1.2579 at 1.2882 will pave the way to retest 1.3070 high, and possibly resume whole up trend from 1.1107.