While Hong Kong HSI and Nikkei, to a lesser extent, are trading deeply lower today, there is little reaction in the forex markets so far. But we’d still pay special attention to Yen crosses in case of a turn into risk-off mode in overall markets. In particular, we’d look at 149.03 support in GBP/JPY and 127.91 support in EUR/JPY to see if Yen is going strong.

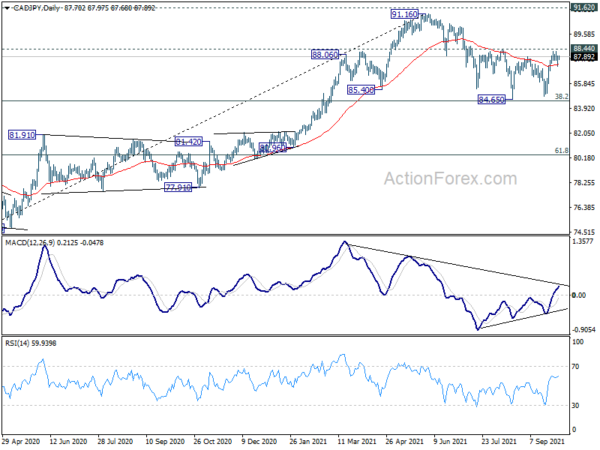

On the other hand, we’d keep an eye on CAD/JPY to gauge if Yen’s selloff is back. CAD/JPY has lost some momentum ahead of 88.44 resistance so far, failing to confirm completion of the correction from 91.16. But at the same time, it’s still holding on 55 day EMA.

On the upside, decisive break of 88.44 resistance, with either help of WTI’s break of 77 handle or rally in stocks, would confirm near term bullishness in CAD/JPY, as well as be an early sign of rally in Yen crosses elsewhere. The stage would be set for a retest on 91.16 high. However, sustained trading below 55 day EMA (now at 87.28) will revive near term bearishness and bring retest of 84.65 low instead.