US stocks closed sharply lower overnight with DOW, S&P 500 and NASDAQ making new lows of the year. As continued aftermath of last week’s CPI data, markets are now adding bets to more aggressive tightening by Fed. The original plan of 50bps hike per meeting seems out of favor.

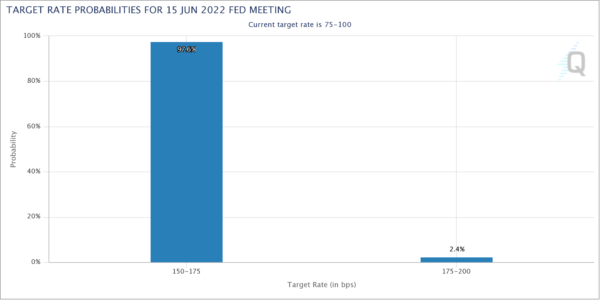

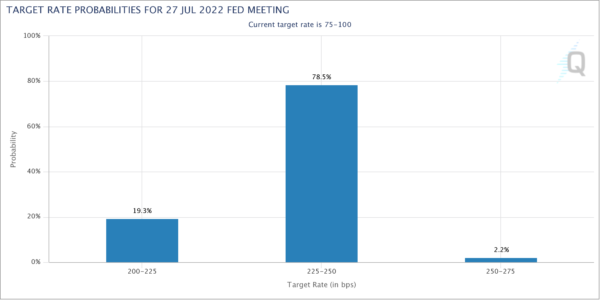

Fed fund futures are now pricing in 99.4% chance of a 75bps hike this week (Wed) to 1.50-1.75%. Further, there is 79.9 chance of another 75bps hike in July to 2.25-2.50%. A pause in September is now a definite no, as markets are expecting another 50bps hike.

Still, the overall expectations would be reshaped by the updated economic projections and the dot plot to be published along with the rate decision.