Gold prices surged in the Asian session today, following a 2% rally on Friday. At the same time, Dollar and Treasury yield were also trading lower. The market was rocked by the bankruptcy of Silicon Valley Bank, which triggered panic and furthered risk aversion. Moreover, it lowered expectations for interest rate hikes as the failure of the second-largest collapse of an American lender in history has raised concerns of potential spillover effects on the financial system.

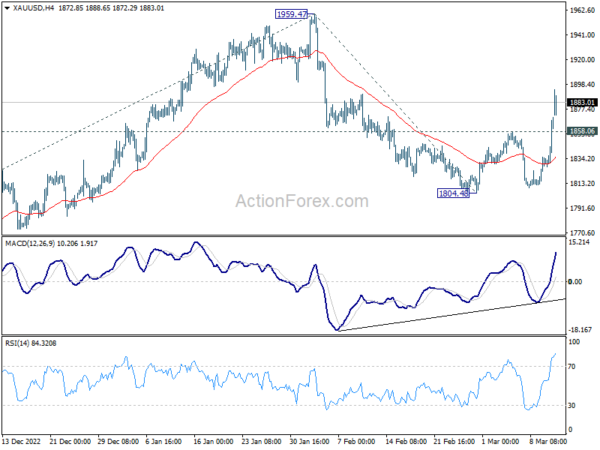

Current development argues that Gold’s decline from 1959.47 has completed at 1804.48 already, on bullish convergence condition in 4 hour MACD. The rise back above 55 day EMA is also a bullish signal. Further rally is expected as long as 1858.06 resistance turned support holds. to retest 1959.47 high.

It’s still early to call for an upside breakout. But decisive break of 1959.47 will resume whole up trend from 1614.60 to 61.8% projection of 1614.60 to 1959.47 from 1804.48 at 2017.60.

However, break of 1858.06 will mix up the near term outlook.