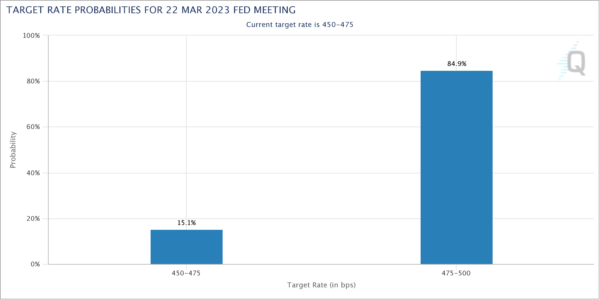

Today marks a significant moment as Fed is expected to continue with its tightening policy. Amid the recent banking crisis and market turmoil, it is widely anticipated that Fed will raise interest rates by 25bps to the 4.75-5.00% range, with around 85% probability. Fed Chair Jerome Powell is likely to stress the importance of bringing inflation back on target during the post-meeting conference, while acknowledging the current market turbulence.

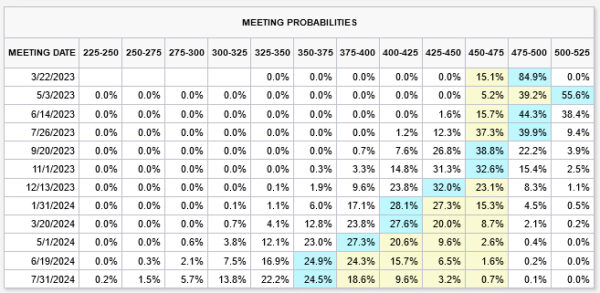

The Fed’s future rate path remains a hot topic of debate. According to Fed fund futures pricing, there is over 55% chance of an additional 25 basis point hike in May, bringing the interest rate to 5.00-5.25%. However, this is followed by a over 62% probability of a -25 basis point cut in June, reverting the rate back to 4.75-5.00%. This apparent contradiction reflects the divided opinions on whether there will be another rate move in May. But in more certainty, traders seem to be leaning more towards a rate cut in September, with around 75% chance of interest rate falling back into the 4.50-4.75% range.

The new staff economic projections scheduled for release today were initially expected to provide some clarity on the future rate path. However, it is speculated that the Fed might choose to delay or suspend these projections, as it did in March 2020 during the onset of the pandemic, to avoid creating further confusion. As a result, a clear answer to the future rate path may remain elusive for now.

Here are some previews:

- Suderman Says: To Raise Rates or Not, Fed Walks a Tightrope

- Fed Faces Dilemma, Hit Pause or Keep Raising Rates?

- Fed Meeting Preview: Dollar Index at 1-month Low ahead of Tight Decision

- Fed to Go Ahead with 25 bp Hike; Canadian CPI Growth to Slow

- Fed Preview – Rate Hikes Continue Despite the Volatility

- March Flashlight for the FOMC Blackout Period: The Flashlight Needs Fresh Batteries