Both Euro and Sterling have made significant gains against Australian and Canadian Dollars this week, resuming medium-term uptrends in respective crosses. Overnight comments from a top ECB official suggest that a 50bps rate hike may be on the table for May policy meeting. Meanwhile, recent UK data underscores the necessity for BoE to extend its tightening measures in order to combat persistently high, double-digit inflation.

On the other hand, there is no data supporting a shift from BoC’s current pause in rate hikes. Australian dollar appears vulnerable ahead of tomorrow’s crucial CPI release, which will likely determine whether RBA will implement a final rate hike in the current cycle.

EUR/AUD’s up trend from 1.4281 is now in progress for 100% projection of 1.4281 to 1.5976 from 1.5254 at 1.6949. Near term outlook will stay bullish as long as 1.6219 support holds, in case of retreat.

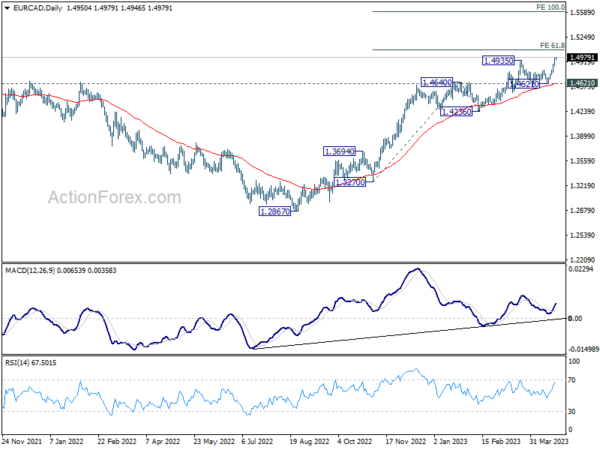

EUR/CAD’s break of 1.4935 confirmed resumption of whole up trend from 1.2867. Immediate target is 61.8% projection of 1.3270 to 1.4640 from 1.4236 at 1.5083. Sustained break there could prompt upside acceleration to 100% projection at 1.5606. Meanwhile, outlook will stay bullish as long as 1.4261 support holds, in case of retreat.

GBP/AUD’s breach of 1.8697 resistance argues that uptrend from 1.5925 is resuming. Outlook will stay bullish as long as 1.8393 support holds, in case of retreat. Sustained trading above 61.8% projection of 1.5925 to 1.8272 from 1.7218 at 1.8668 could prompt upside acceleration to 1.9218 resistance and then 100% projection at 1.9565.

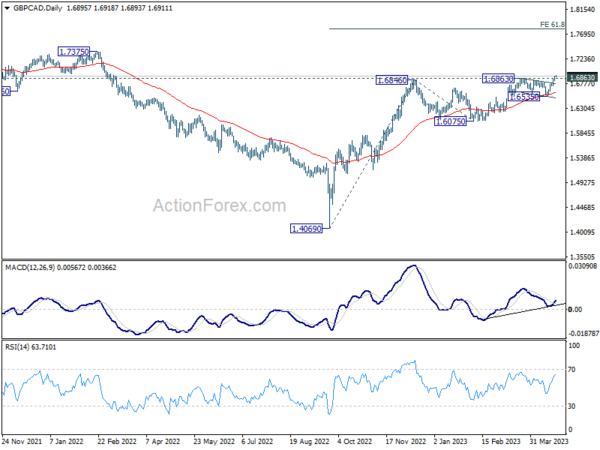

GBP/CAD’s break of 1.6846 resistance also indicates resumption of up trend from 1.4069. Near term outlook will stay bullish as long as 1.6535 support holds. Current rise should target 61.8% projection of 1.4069 to 1.6846 from 1.6075 at 1.7791 next.