As BoC is widely expected to raise interest rates by another 25 bps to 5.00% today, the financial market awaits the answer on whether this move marks the end of the current tightening cycle. The hike today is expected after the bank restarted tightening last month, with many speculating that terminal rate could be reached with this adjustment.

However, the future pathway is fraught with uncertainties, and the key focus will be on how BoC chooses to communicate its stance. There are anticipations that Governor Tiff Macklem may maintain a hawkish tone, keeping options open and underscoring the bank’s determination to combat inflation that continues to overshoot target. Alternatively, the bank may more explicitly signal another “conditional pause”, like it did in January. Regardless of the approach, the new economic forecasts to be released today will be crucial in underpinning their message.

Some previews on BoC:

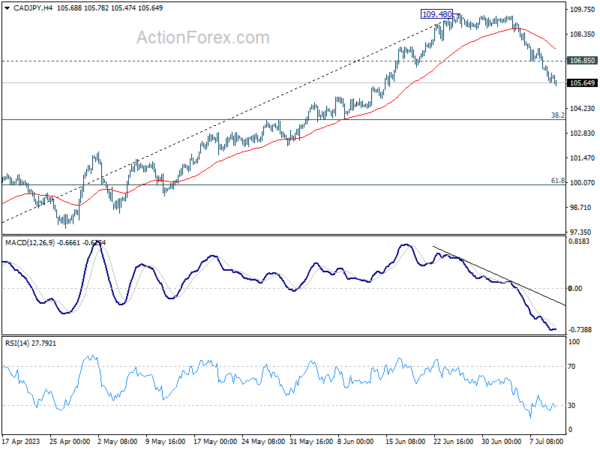

CAD/JPY is continuing the fall from 109.48 short term top today. The favored case is that this decline from 109.48 is the third leg of the pattern from 110.87 high. Sustained break of 55 D EMA (now at 104.86) would solidify this bearish case and target 38.2% retracement of 94.04 to 109.48 at 103.58 next. Break of 106.85 minor resistance will mix up the outlook and bring recovery first. But even in this case, risk will stay mildly on the downside as long as 109.48 resistance holds.