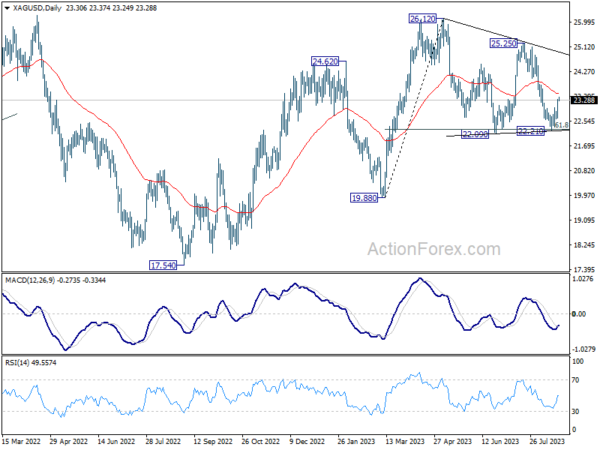

Silver’s rebound from 22.21 extended higher overnight and the development should confirm short term bottoming there. A bullish scenario for Silver is that consolidation from 26.12 has completed with three waves to 22.21, after defending 61.8% retracement of 19.88 to 26.12 at 22.26 twice.

Sustained trading above 55 D EMA (now at 23.50) will bolster the bullish case for silver and bring stronger rise back to trend line resistance (now at 24.92). However, rejection by 55 D EMA will argue that current recovery is merely some short-covering profit taking, and send Silver through 22.09 support at a later stage to extend the fall from 26.12.

At the same time, Gold is still trying to defend 38.2% retracement of 1614.60 to 2062.95 at 1891.68. A stronger bounce in Silver could be accompanied by similar rebound in Gold back towards 55 D EMA (now at 1933.55). However, if the bearish case in Silver plays out, Gold would likely clear 1891.68 fibonacci support accelerate down to 100% projection of 2062.95 to 1892.76 from 1987.22 at 1817.03.