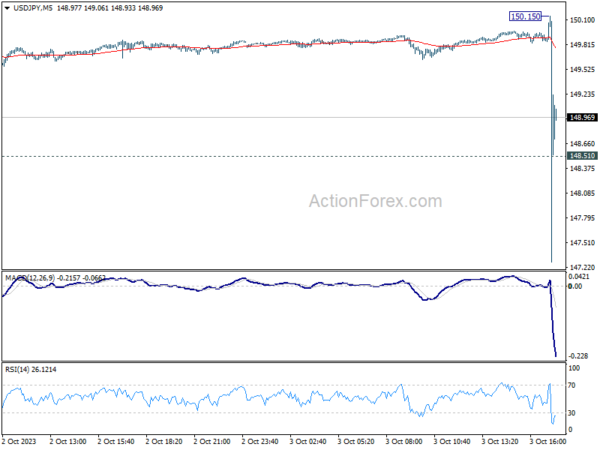

In a significant move, Japan finally took a decisive step to intervene in the currency markets after USD/JPY briefly surged past the 150 mark, reaching 150.15. A rapid dip followed, with the pair plummeting to 147.25 in a mere five minutes.

However, the pair’s quick resurgence above 148 indicates a lack of speculative sell-off aligned with Japan’s intervention, as well as resilience of Yen bears. Thus, it’s premature to forecast a trend reversal.

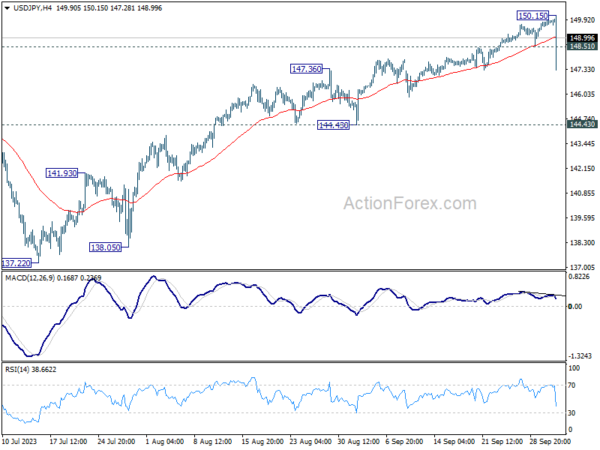

In the coming days, eyes will be on the prospect of another approach towards the 150 mark, in response to US ISM services and non-farm payrolls. That’s a point at which Japan may consider a second intervention. Then we’d know more about the determination of both sides.

The ascendancy of USD/JPY to 150.15 came on the back of robust US Job Openings and Labor Turnover Survey (JOLTS) data. The survey revealed 9.6 million job openings in August, a substantial increase from the revised 8.9 million in July. Furthermore, the rate at which employees quit their jobs, seen as an indicator of workers’ confidence in job prospects, remained steady at 2.3%.

Purely from a technical point of view, near term outlook is neutral at worst as long as 144.43 support holds. While there might volatility, and choppy price actions, USD/JPY is just engaging in near term consolidations.