UK’s PMI Manufacturing edged up from 47.0 to 47.1, aligning with expectations, while PMI Services was steady at 54.3, just shy of the anticipated 54.4. PMI Composite index rose from 52.9 to 53.3, underscoring a period of accelerated economic growth and marking the highest reading in nine months.

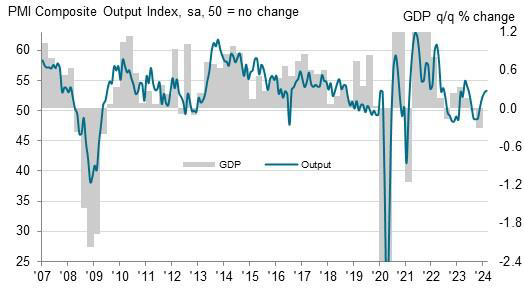

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, emphasized the significance, noting that recent uptick is part of a consistent pattern of improvement over the “four straight months”. Williamson’s analysis suggests that the economy is expanding at a quarterly rate of 0.2-0.3% in Q1 2024, signaling that UK’s recessionary phase may have concluded.

Williamson highlighed supply chain disruptions, particularly those related to Red Sea shipping, have led to the most significant delays observed in over 18 months. These disruptions have escalated shipping costs, contributing to a notable increase in selling prices for goods—the largest monthly rise seen in nine months.

Moreover, service sector inflation has edged higher due to increased wage costs and the indirect effects of rising goods prices. The survey data suggest consumer price inflation may hover around 4% in the coming months, doubling BoE’s target rate.

Given these dynamics—accelerating growth coupled with rising prices—February’s PMI data suggests that BoE are “increasingly likely to err on the side of caution” towards reducing interest rates.