Fed Chairman Jerome Powell is set to begin his two-day semiannual Congressional testimony today, drawing significant attention from the markets as participants seek clarity on the Fed’s monetary policy direction for the year. Key questions include the timing of the first rate cut and the total number expected throughout the year.

Powell is anticipated to reiterate the cautious stance echoed by his colleagues, indicating that Fed is not in a hurry to lower interest rates. The central bank seeks further assurance that inflation is on a consistent downward path to target before considering rate reductions. Regarding the number of rate cuts, Powell may reference the median projection of three cuts this year, emphasizing that any adjustments will be contingent on incoming economic data.

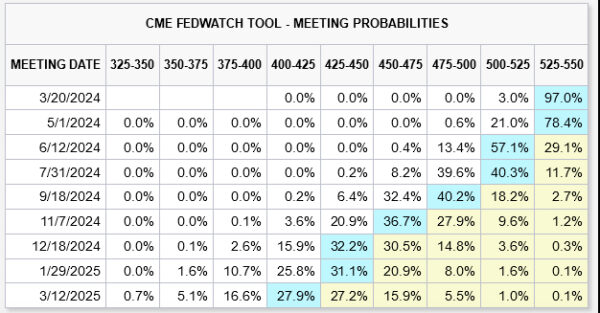

Currently fed fund futures suggest a slightly less than 70% probability of the initial rate cut occurring in June. By year-end, the likelihood exceeds 80% that federal funds rate will adjust to a range of 4.50-4.75%, marking three 25bps reductions from the present 5.25-5.50% level.

A key to watch is the reactions in 10-year yields the break of 55 D EMA (now at 4.188) affirms the case that corrective recovery from 3.785 has completed at 4.354 already. Risk will now stay on the downside as long as this EMA holds. Deeper fall is in favor towards 3.785 low. This development would keep Dollar under some pressure, or at least cap its rally momentum. A daily close above 55 EMA would delay the bearish case. But upside potential for rebound should be limited below 4.354.