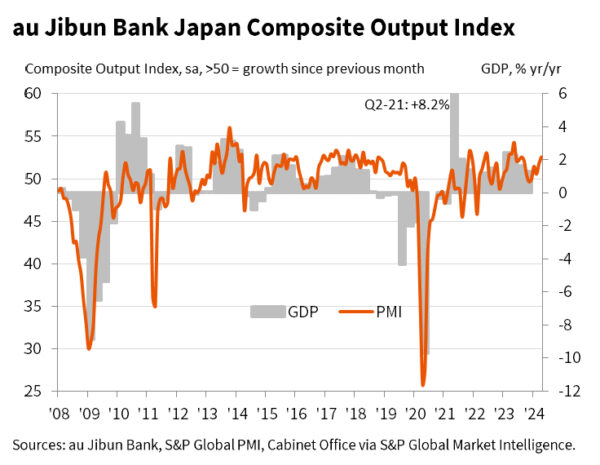

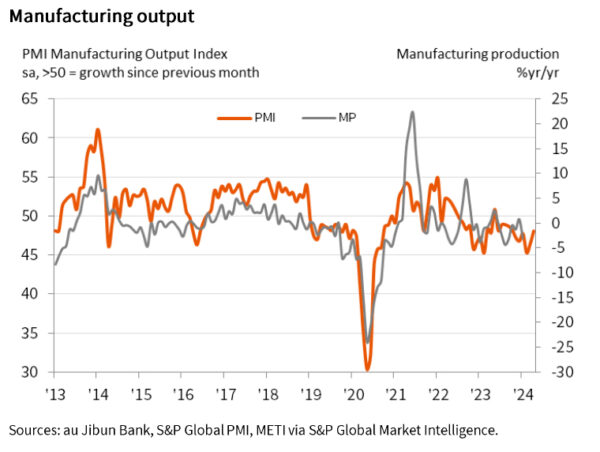

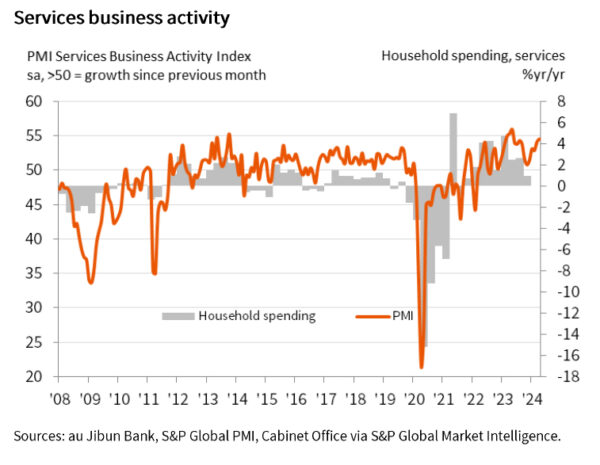

Japan’s PMI Manufacturing rises from 48.2 to 49.9 in April, above expectation of 48.0, signalling a near-stabilization of manufacturing business conditions. PMI Services rises from 54.1 to 54.6, highest since May 2023. PMI Composite also rose from 51.7 to 52.6, matching the joint-fastest pace set in nearly a year.

Jingyi Pan, Economist Associate Director at S&P Global Market Intelligence, noted that while the service sector continues to be the main driver of growth, there are positive developments in manufacturing as well, where the decline in output has lessened.

April’s data, however, also unveiled “additional signs of intensifying price pressures” which were largely attributed to higher input costs inflation affecting both the goods and services sectors.

Notable factors contributing to these rising costs include increased expenses for materials, energy, and wages, with the “weaker Yen having played a significant part as well”. Consequently, businesses have been compelled to pass these increased costs onto their clients, resulting in the “fastest increase in average charges in a year.”