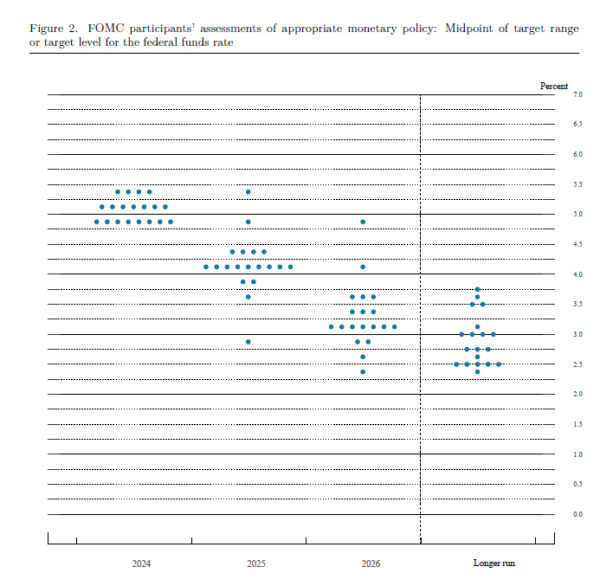

Fed left interest rates unchanged at 5.25-5.50% as widely expected. The new economic projections are slightly on the hawkish side, indicating that the majority of FOMC expects only one rate cut this year. The neutral rate was also raised. But investors could be relieved that no FOMC member expects any more rate hike.

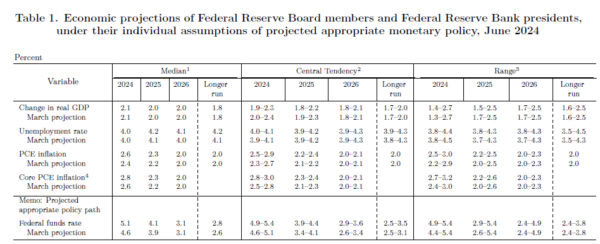

In the latest median projections, federal funds rate forecast was raised from 4.6% to 5.1% by the end of 2024, indicating only one rate cut fro current level. Federal funds rate is projected to fall to 4.1% (prior 3.9%) by the end of 2025, and 3.1% (unchanged_) by the end of 2026. Additionally, the longer run interest rate was raised from 2.6% to 2.8%, indicating a higher neutral rate.

GDP growth forecasts were left unchanged at 2.1% in 204, 2.0% in 2025 and 2.0% in 2026. Headline PCE inflation was raised to 2.6% (up from 2.4%) in 2024, raised to 2.3% (up from 2.2%) in 2025, and left unchanged at 2.0% in 2026. Core PCE inflation forecast was also raised to 2.8% (up from 2.6%) in 2024, raised to 2.3% (up from 2.2%) in 2025, and left unchanged at 2.0% in 2026.

In the new dot plot, no policymaker makers expect any more rate hike. Four expects interest rate to stay unchanged at 5.25-5.50% through 2024 while seven expect one rate cut to 5.00-5.25%. Eight members project two rate cuts to 4.75-5.25% this year.