S&P 500 and NASDAQ extended their record runs overnight, but that was mainly fueled by softer-than-expected May US CPI data. Market reaction to FOMC’s rate decision was indeed subdued, reflecting the balanced nature of the new economic projections and dot plot, which offered something for both hawks and doves.

On the hawkish side, the median projection now indicates only one rate cut this year, a sharp shift from the three cuts anticipated back in March. The balance of the dot plot showed 11 members favoring one or no cuts versus 8 members advocating for two cuts, indicating a significant hurdle for those seeking more aggressive rate reductions.

Although some argue that not all FOMC members vote on policy decisions, potentially making the actual voting balance more dovish, it’s clear that Fed will require further encouraging inflation data, similar to the yesterday’s May CPI figures, before considering any policy easing.

Another hawkish signal was the increase in the long-run “neutral” rate from 2.6% to 2.8%. This rate has now risen by more than a quarter of a percentage point over Fed’s last two sets of projections. That suggests officials believe inflation will be more challenging to control in the future. However, Fed Chair Jerome Powell downplayed the significance of this increase, noting that it does not necessarily influence short-term rate projections.

On the dovish side, no FOMC members projected another rate hike, compared to two who had previously indicated the possibility of one more hike. This consensus suggests that all policymakers prefer to maintain the current interest rate level to combat inflation rather than tightening further, which should reassure most investors.

Going forward, Powell emphasized that Fed would make decisions based on the totality of incoming data rather than pre-determining future actions. He elaborated, “it’s going to be not just the inflation readings. It’s going to be the totality of the data, what’s happening in the labor market, what’s happening with the balance of risks, what’s happening with the forecasts, what’s happening with growth.”

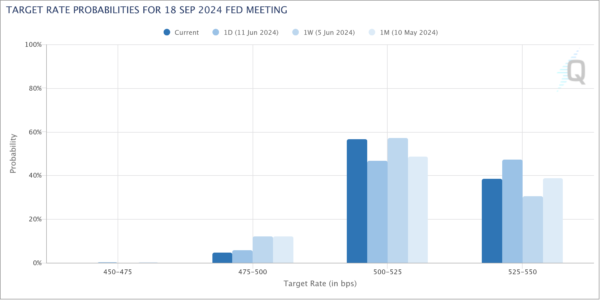

Currently, Fed funds futures indicate a 61% chance of a rate cut in September, even lower than the 69% chance a week ago before the release of strong non-farm payroll data. The odds would likely continue to fluctuate in the current range until significant progress is seen in disinflation.