SNB left sight deposit rates unchanged at -0.75%, three-month Libor range at -1.25% to -0.25%, as widely expected. Inflation forecasts for 2018 and 2019 are lowered due to Swiss Franc’s appreciation to Dollar. SNB maintained that negative rate and intervention are essential

Latest forecasts:-

- 2018 inflation forecast: 0.6% (prior 0.7%)

- 2019 inflation forecast: 0.9% (prior 1.1%)

- 2020 inflation forecast: 1.9%

- 2018 GDP forecast: around 2%

Key quotes from the release:-

- Since the last monetary policy assessment in December, the Swiss franc has appreciated slightly overall on the back of the weaker US dollar.

- The Swiss franc remains highly valued.

- The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market as necessary therefore remain essential.

- The SNB continues to expect GDP growth of around 2% for 2018 and a further gradual decrease in unemployment.

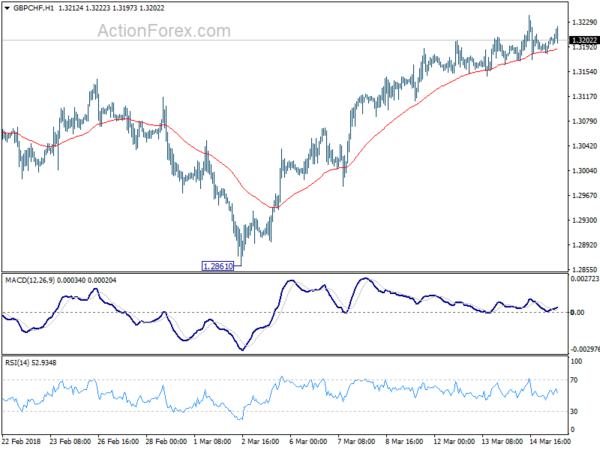

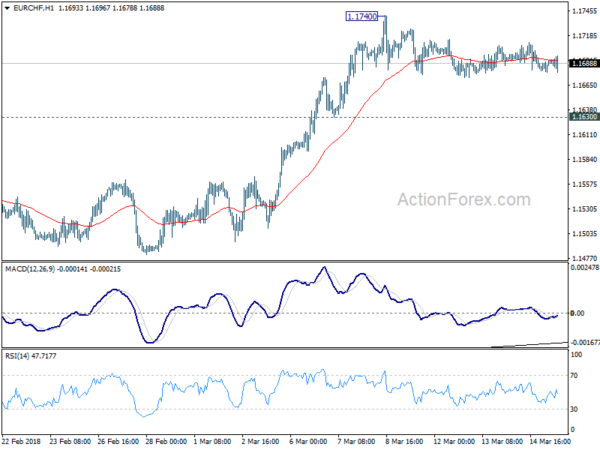

Market reactions to the release is muted as seen from EUR/CHF, USD/CHF and GBP/CHF below.