ISM manufacturing index rose dropped to 59.3 in March, down from 60.8 and was slightly below expectation of 60.0. Prices paid component surged to 78.1, up from 74.2, beat expectation of 72.5. Employment component dropped to 57.3, down from 59.7.

Overall, despite slight deterioration in the headline index and employment component, the set of data remained solid. However, there were some concerns expressed regarding the newly announced tariffs. As noted in the “What respondents are saying section…” section of the release:

- “Much concern in the industry regarding the steel and aluminum tariffs recently [imposed]. This is causing panic buying, driving the near-term prices higher and [leading to] inventory shortages for non-contract customers.” (Machinery)

- “New tariffs are causing concern across the supply chain. Full impact will take a few weeks to reveal itself.” (Miscellaneous Manufacturing)

- “Significant price increases in the steel commodity due to 232 [the tariffs]. The price increases will begin to impact our company’s performance.” (Primary Metals)

The release itself also noted that “the Prices Index registered 78.1 percent in March, a 3.9 percentage point increase from the February reading of 74.2 percent, indicating higher raw materials prices for the 25th consecutive month.”

This could be the reason why dollar is trying to have a positive response to the release while stocks extends initial weakness.

Also released in US session, US construction spending rose 0.1% mom in February. Manufacturing PMI was revised down to 55.6 in March. Canada manufacturing PMI rose 0.1 to 55.7 in March.

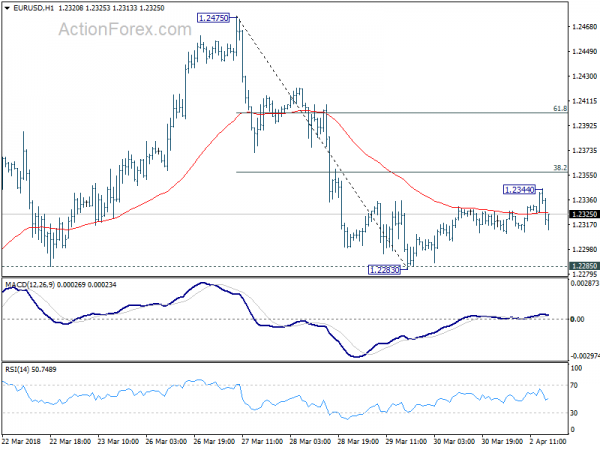

EUR/USD recovered earlier after drawing support form 1.2283. But such recovery lost momentum after hitting 1.2344. But so far, there is no follow through selling on the dip from 1.2344 yet. Hourly chart suggests that the fall from 1.2475 is going to resume after finishing the recovery from 1.2283. But we’d point to 1.2285 as an important near term support. Hence, it has to be firmly broken to confirm underlying momentum.