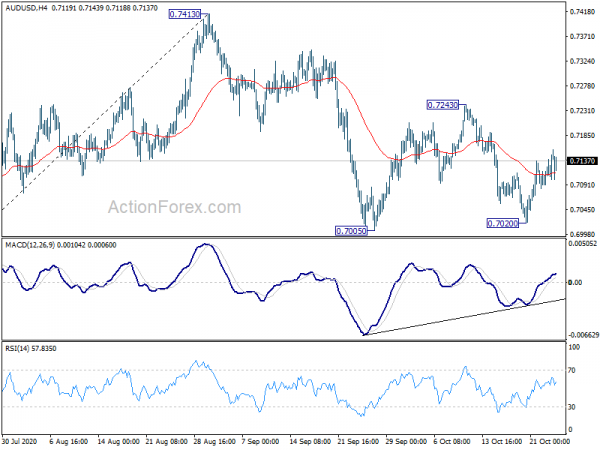

AUD/USD recovered ahead of 0.7005 last week but upside was limited well below 0.7243 resistance so far. Initial bias stays neutral this week first and further fall is mildly in favor with 0.7243 resistance intact. On the downside, break of 0.7005 will resume the corrective fall from 0.7413, and target 38.2% retracement of 0.5506 to 0.7413 at 0.6685. However, firm break of 0.7243 will bring retest of 0.7413 high.

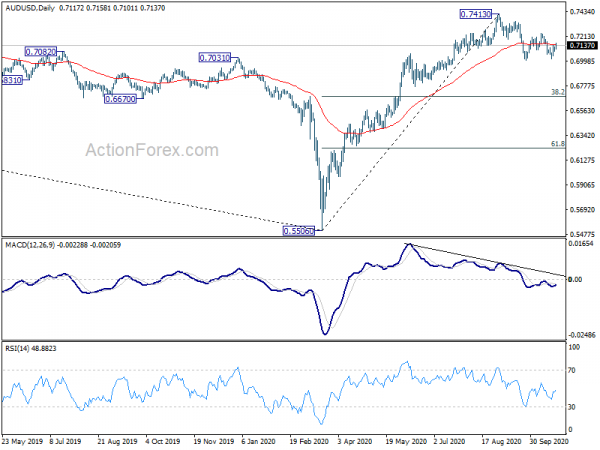

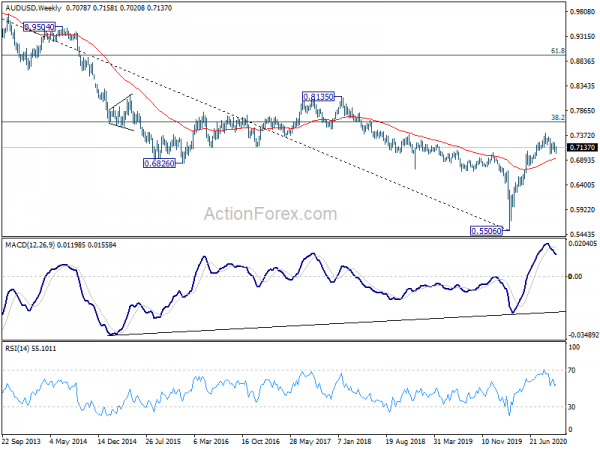

In the bigger picture, while rebound from 0.5506 was strong, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a correction inside the long term down trend. Sustained trading back below 55 week EMA (now at 0.6916) will favor the bearish case and argue that the rebound has completed. Focus will be turned back to 0.5506 low. On the upside, break of 0.7413 will extend the rise from 0.5506 to 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635.

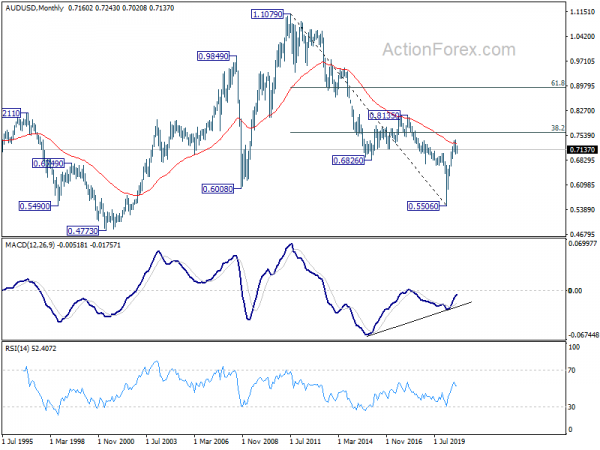

In the longer term picture, bullish convergence condition in monthly MACD is a condition for long term bullish reversal. Yet, AUD/USD struggled to sustain above 55 month EMA (now at 0.7306). It’s also limited below 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635. Hence, there is not enough evidence for reversal yet. Down trend from 1.1079 could still extend through 0.5506 at a later stage.