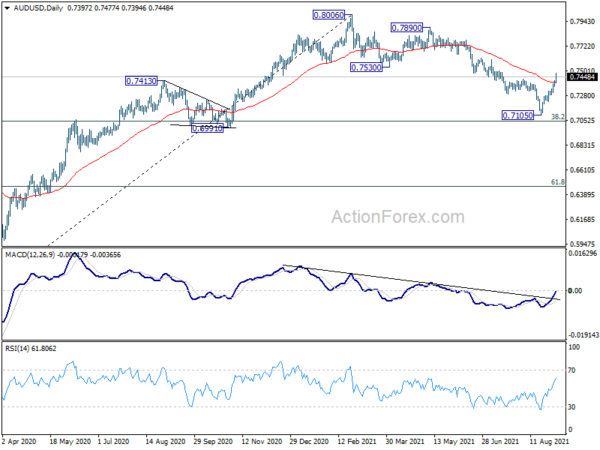

AUD/USD’s rise from 0.7105 accelerated to as high as 0.7477 last week. The break of 0.7425 resistance suggests that whole correction from 0.8006 has completed at 0.7105 already, just above 0.6991/7051 support zone. Initial bias stays on the upside this week for 0.7530 support turned resistance first. Sustained break there will bring retest of 0.8006 high. On the downside, break of 0.7354 minor support will turn intraday bias neutral and bring consolidations first.

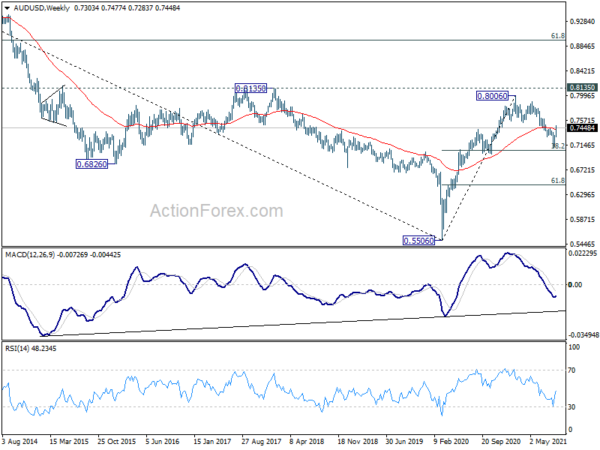

In the bigger picture, with 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051) intact, we’re seeing price action form 0.8006 as a correction only. That is, up trend from 0.5506 low would resume after the correction completes. In that case, main focus will be 0.8135 key resistance (2018 high). Sustained break there will carry larger bullish implications. However, sustained break of 0.6991 will argue that the whole medium term trend has indeed reversed.

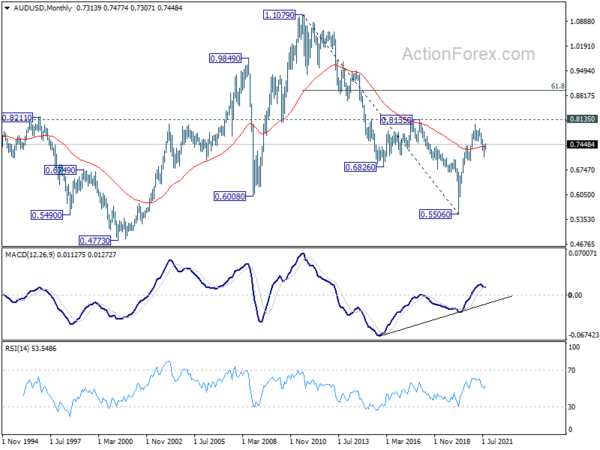

In the longer term picture, focus remains is back on 0.8135 structural resistance. Decisive break there will argue that rise from 0.5506 is developing into a long term up trend that reverses whole down trend from 1.1079 (2011 high). In that case, further rally would be seen to 61.8% retracement of 1.1079 to 0.5506 at 0.8950 and possibly above.