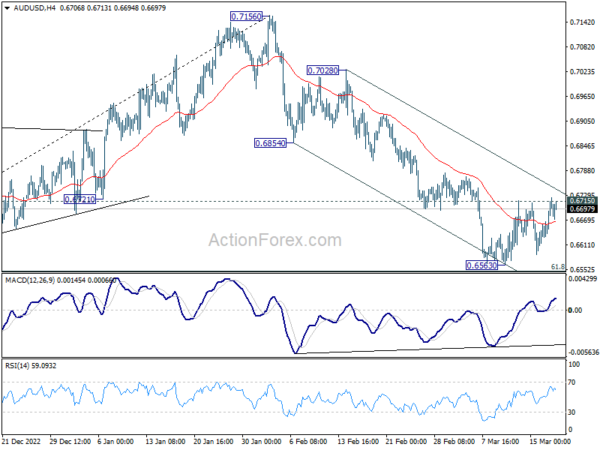

While AUD/USD recovered last week, it failed to break through 0.6715 resistance decisively. Initial bias remains neutral first. On the upside, decisive break of 0.6715 will confirm short term bottoming at 0.6563, just ahead of 0.6546 fibonacci level. Intraday bias will be back on the upside for 55 day EMA (now at 0.6784). Sustained break there will pave the way back to retest 0.7156 high. On the downside, however, sustained break of 0.6546 will carry larger bearish implication and target 0.6169 low.

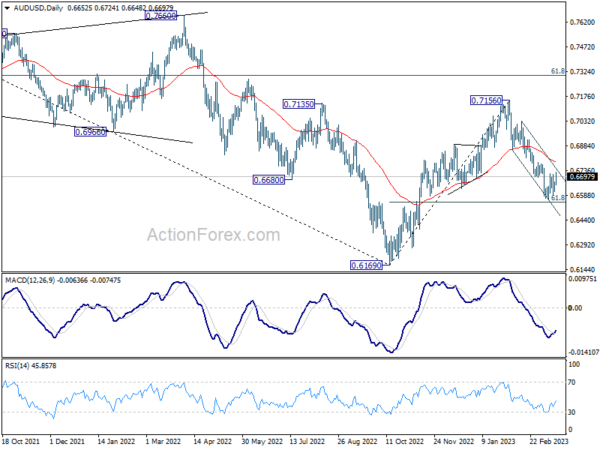

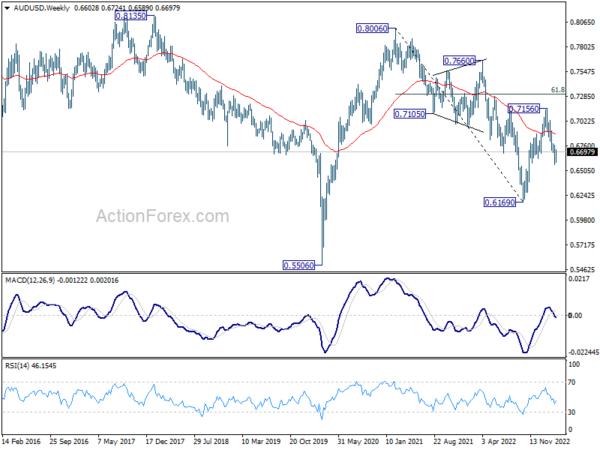

In the bigger picture, rise from 0.6169 (2022 low) has completed at 0.7156, after rejection by 55 month EMA (now at 0.7158). Deeper decline would then be see back to 61.8% retracement of 0.6169 to 0.7156 at 0.6546, even as a corrective fall. Sustained break there will raise the chance of long term down trend resumption through 0.6169 low.

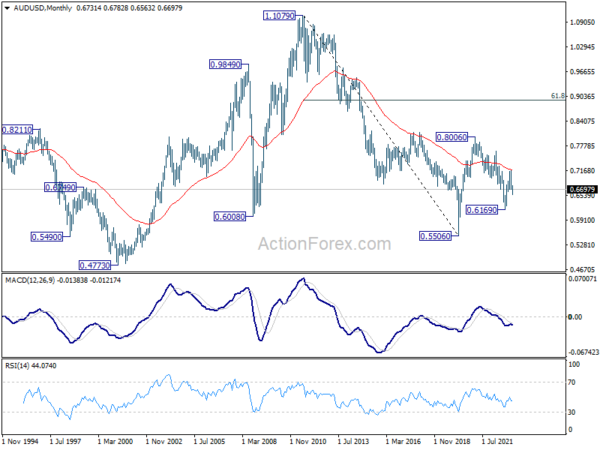

In the long term picture, initial rejection by 55 month EMA (now at 0.7158) retains long term bearishness. That is, down trend from 1.1079 (2011 high) could still resume through 0.5506 (2020 low) on resumption.