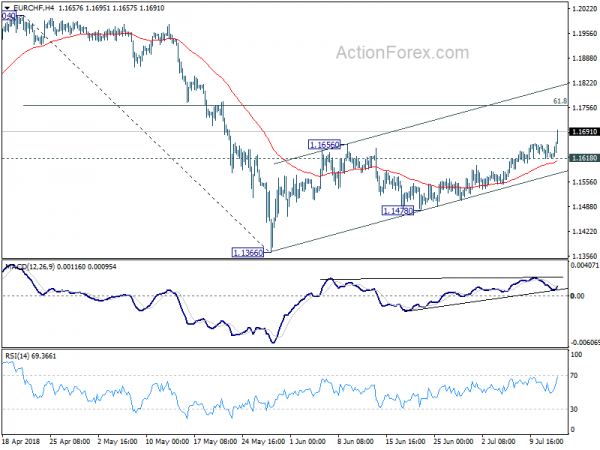

Daily Pivots: (S1) 1.1611; (P) 1.1636; (R1) 1.1652; More…

EUR/CHF finally breaks 1.1656 resistance with conviction. Intraday bias is now on the upside for further rise to 61.8% retracement of 1.2004 to 1.1366 at 1.1760. At this point, we’re viewing the rebound from 1.1366 as the second leg of the corrective pattern from 1.2004. And another fall is expected before the correction from 1.2004 completes. Therefore, we’d expect strong resistance around 1.1760 to limit upside. On the downside, below 1.1618 will turn bias back to the downside for 1.1478 support and below. However, sustained trading above 1.1760 will pave the way to retest 1.2004 high next.

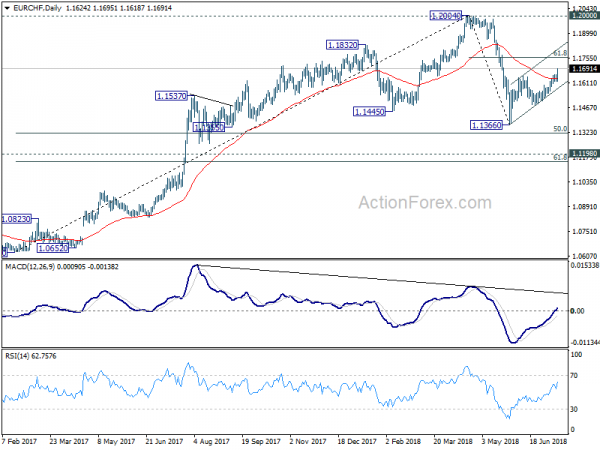

In the bigger picture, EUR/CHF was solidly rejected by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.