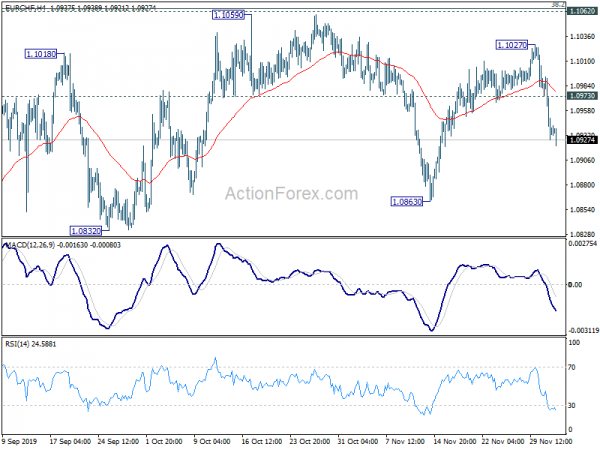

Daily Pivots: (S1) 1.0914; (P) 1.0954; (R1) 1.0979; More…

Intraday bias in EUR/CHF remains on the downside at this point. Rise form 1.0863 should have completed at 1.1027. Deeper fall should be seen back to 1.0811/63 support zone. Decisive break there will indicate larger down trend resumption. On the upside, above 1.0973 minor resistance will turn intraday bias neutral first. In case of another rise, upside should be limited by 1.1062 cluster resistance (38.2% retracement of 1.1476 to 1.0811 at 1.1065).

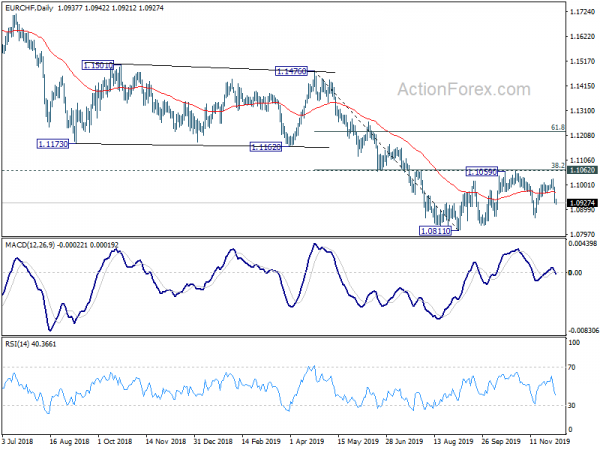

In the bigger picture, down trend from 1.2004 is (2018 high) is still in progress. More importantly, it’s likely a long term down trend itself, rather than a correction. Further fall should be seen to 1.0629 support and possibly below. On the upside, break of 1.1162 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will remain bearish in case of rebound.