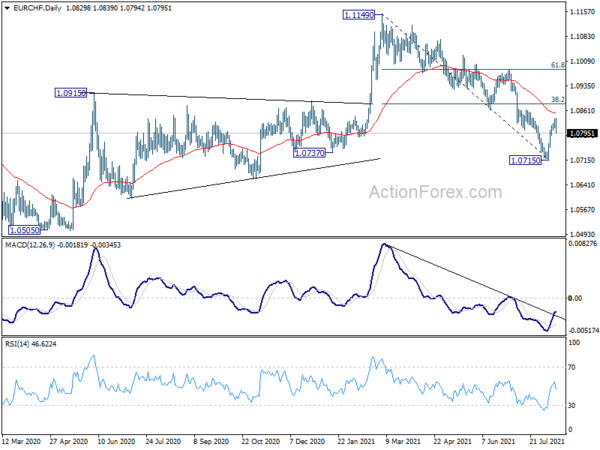

EUR/CHF rebounded strongly last week and hit as high as 1.0839, but retreated sharply since then. Initial bias remains neutral this week first. Another rise is mildly in favor as long as 1.0788 minor support holds. Above 1.0839 will resume the rebound from 1.0715 short term bottom to 38.2% retracement of 1.1149 to 1.0715 at 1.0881. We’d monitor the reaction to 1.0881 to assess the chance of bullish reversal. On the downside, break of 1.0788 minor support will turn bias back to the downside for retesting 1.0715 low instead.

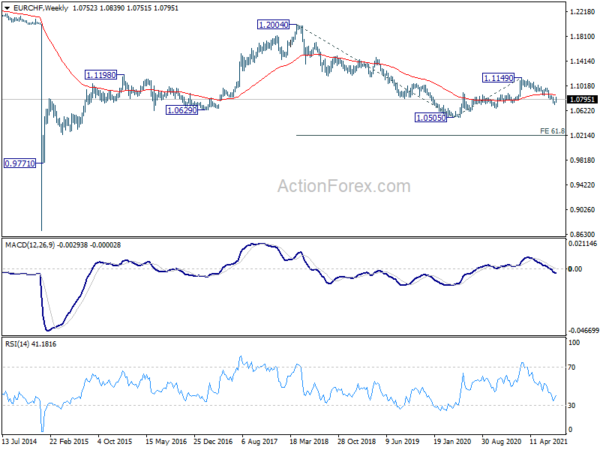

In the bigger picture, rebound from 1.0505 (2020 low) should have completed at 1.1149 already. The three-wave corrective structure argues that the downtrend from 1.2004 (2018 high) is not over yet. Medium term outlook will now stay bearish as long as 55 week EMA (now at 1.0869) holds. Break of 1.0505 low would be seen at a later stage.

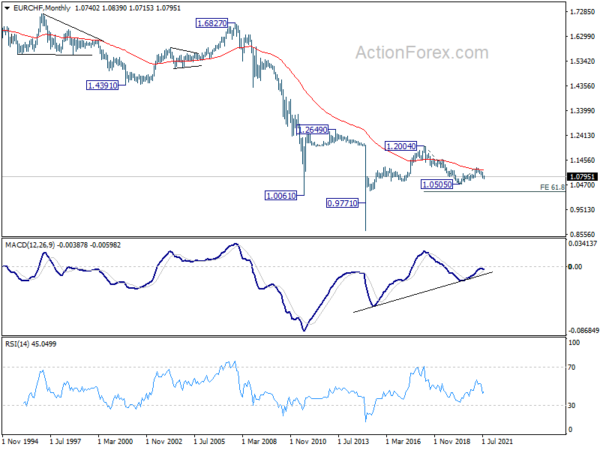

In the long term picture, rejection by 55 month EMA (now at 1.1058) retains long term bearishness. Break of 1.0505 low will resume down trend to 61.8% projection of 1.2004 to 1.0505 to 1.1149 at 1.0223.