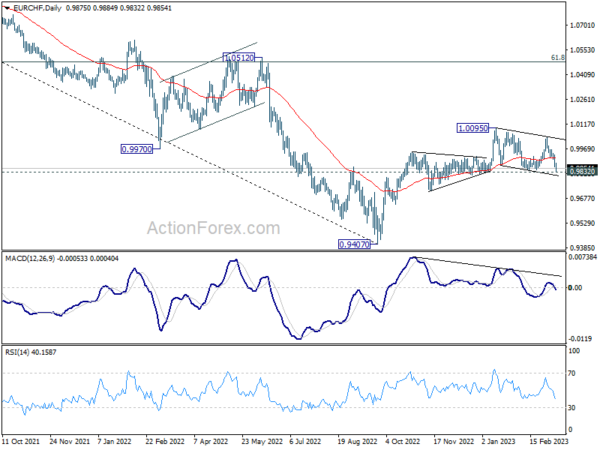

Daily Pivots: (S1) 0.9846; (P) 0.9889; (R1) 0.9912; More….

EUR/CHF’s decline continues today and immediate focus is now on 0.9832. Strong rebound from current level, followed by break of 0.9892 minor resistance, will argue that fall from 1.0040 has completed. Intraday bias will be turned back to the upside for 1.0040/95 resistance zone. However, sustained break of 0.9832 will carry larger bearish implication and target 0.9407 low again.

In the bigger picture, with 0.9832 support intact, rise from 0.9407 (2022 low) is still expected to continue. Break of 1.0095 and sustained trading above 55 week EMA (now at 1.0021) will be a medium term bullish signal, and bring further rally to 1.0505 cluster resistance (2020 low at 1.0505, 61.8% retracement of 1.1149 to 0.9407 at 1.1484). However, firm break of 0.9832 support will revive medium term bearishness and bring retest of 0.9407 low instead.