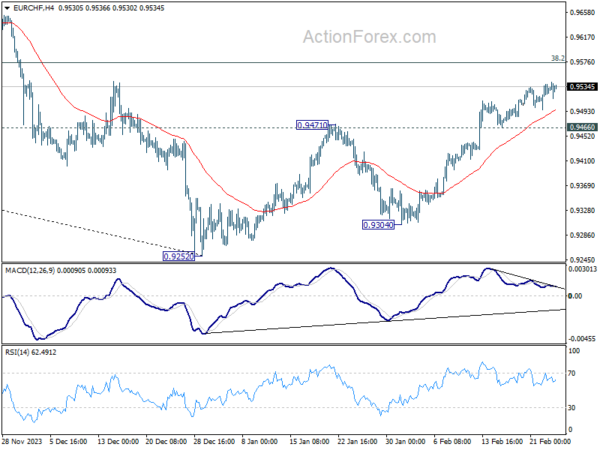

EUR/CHF’s rebound from 0.9252 continued last week and initial bias stays on the upside this week for 0.9574 fibonacci level next. However, considering bearish divergence condition in 4H MACD, strong resistance could be seen from 0.9574 to limit upside. On the downside, break of 0.9466 support will indicate short term topping, and turn bias back to the downside.

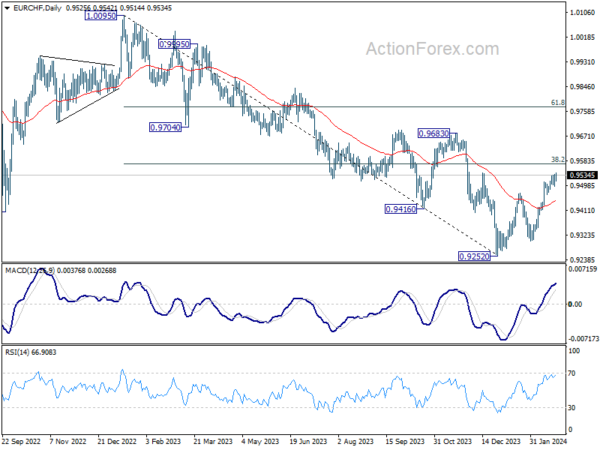

In the bigger picture, price actions from 0.9252 are tentatively seen as a correction to the five-wave down trend from 1.0095 (2023 high). Further rise would be seen to 38.2% retracement of 1.0095 to 0.9252 at 0.9574 and possibly above. But overall medium term outlook will remain bearish as long as 0.9683 resistance holds.

In the long term picture, fall from 1.2004 (2018 high) is part of the multi-decade down trend. Firm break of 1.0095 resistance is needed to be the first sign of long term bottoming. Otherwise, outlook will remain bearish.