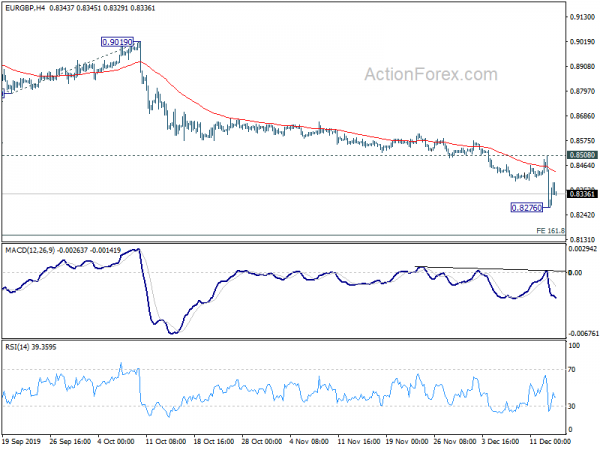

EUR/GBP’s fall accelerated to as low as 0.8276 last week. A temporary low was formed there with subsequent recovery. Initial bias is neutral this week for some consolidations first. Upside of recovery should be limited by 0.8508 resistance to bring fall resumption. On the downside, below 0.8276 will resume the decline from 0.9324 and target 161.8% projection of 0.9324 to 0.8786 from 0.9019 at 0.8149 next.

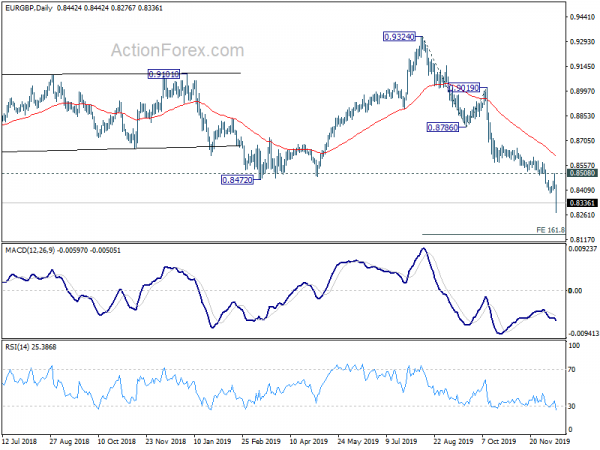

In the bigger picture, fall from 0.9324 medium term top is still in progress. 38.2% retracement of 0.6935 to 0.9324 at 0.8411 was firmly taken out. Further decline should now be seen to 61.8% retracement at 0.7848 next. In any case, further decline would remain in favor as long as 0.8786 support turned resistance holds, even in case of strong rebound.

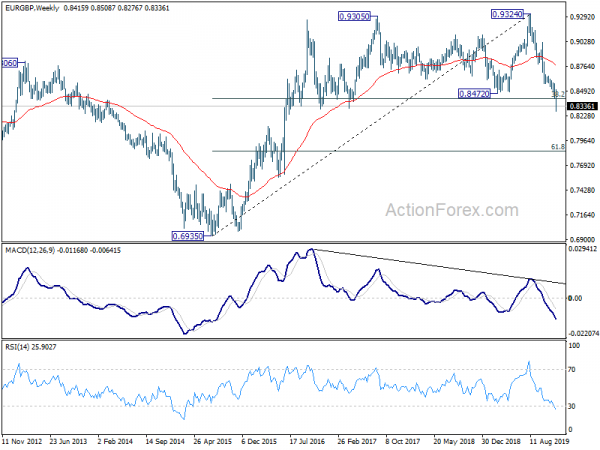

In the long term picture, the strong break of 55 month EMA now suggests that rise from 0.6935 (2015 low) has completed at 0.9324 already. However fall from there could be the third leg of the whole pattern from 0.9799 (2008 high). It’s a bit early to judge how fall the decline would extend to and whether 0.6935 would be taken out. We’ll pay attention to the structure of the fall from 0.9324 and corresponding downside momentum to made an assessment later.