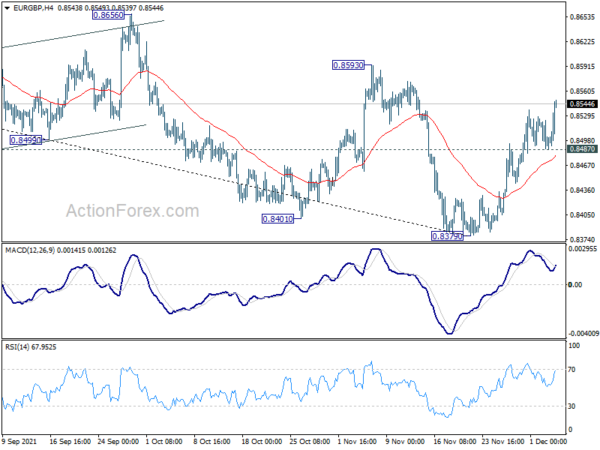

EUR/GBP’s rebound from 0.8379 continued last week and hit as high as 0.8549. Initial bias is on the upside this week for 0.8593 structural resistance next. Sustained break there will be the first sign of larger bullish reversal and target 0.8656 resistance next. On the downside, break of 0.8487 minor support will turn bias back to the downside for 0.8379 low instead.

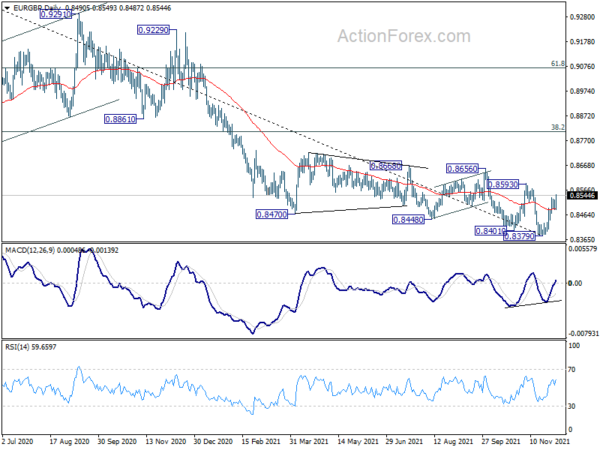

In the bigger picture, price actions from 0.9499 (2020 high) are still seen as developing into a corrective pattern. Deeper fall could be seen as long as 0.8593 resistance holds, towards long term support at 0.8276. We’d look for bottoming signal around there to bring reversal. Meanwhile, firm break of 0.8593 will now be an early sign of medium term bottoming. Further break of 0.8656 will pave the way to 38.2% retracement of 0.9499 to 0.8379 at 0.8807.

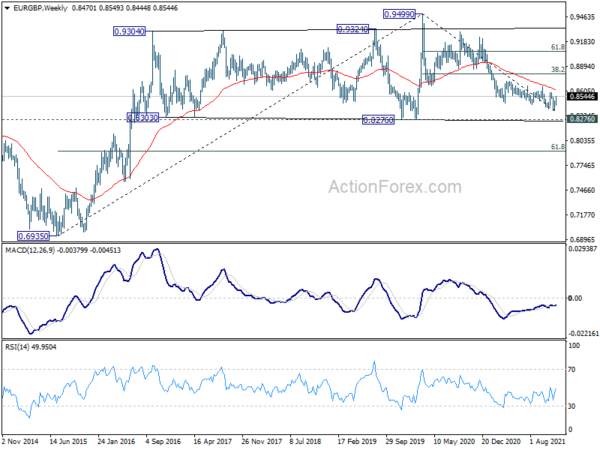

In the long term picture, outlook will stay bullish as long as 0.8276 support holds. Break of 0.9499 is in favor at a later stage, to resume the up trend from 0.6935 (2015 low). However, sustained break of 0.8276 will indicate long term trend reversal, and target 61.8% retracement of 0.6935 to 0.9499 at 0.7917, and possibly below.